Every month I share a quick recap of what happened over the last 31 days. In these posts, I share a bunch of details – what’s going on in my life, progress towards goals I’m working on, a breakdown of our spending over the last month and a look at our investments.

I absolutely love reading this kind of insight for others. It was one of the things that started to make it clear how people go about retiring early, what they focus their time on and how investing changing over time. My hope is that others will get equal value from my takeaways.

- What’s new with me?

- Goals and progress update

- Spending, income, and expenses

- Current investments

- What’s next?

I learn a lot about myself through journaling. Taking time to put into words how things are going and reflecting on them helps to focus my thoughts and make sure I’m working towards what matters most. If you write something similar each month, feel free to share it in the comments – I love reading them.

Here’s a look at some previous updates:

- May 2019 Update

- April 2019 Update

- March 2019 Update

- 2018 Q4 Winter Investment Report

- 2018 Q3 Fall Investment Report

- 2018 Q2 Summer Investment Report

- 2018 Q1 Spring Investment Report

- 2017 Q4 Winter Investment Report

- 2017 Q3 Fall Investment Report

Since leaving my job at the end of 2018, I took 2 months off, then started writing these monthly. Here’s a look at what I’ve been up to!

1. What’s New With Me?

June went by in a flash. After working on Minafi v2 for a few months earlier this year, May & June have been more focused on getting outside and enjoying the warmer weather! It snowed here in late April, making for a later-than-usual summer and hiking season. Here’s a quick recap of a few highlights from this past month.

Played some games with friends. I love having friends that enjoy games. We introduced a few friends to Settlers of Catan one night, then had a blast playing a 10-person game of Secret Hitler on another. These are two of my favorites, and playing them over a few drinks with good friends is always a highlight.

Went on a number of hikes including Mount Olympus (a 4,000ft+ gain hike!), Adam’s Canyon with Aaron from Personal Finance for Beginners, and a sunset hike to Ensign Peak (an easy hike, but a favorite)

Ensign Peak View Ensign Peak Sunset Me at the waterfall A dog (and it’s people) followed me up

Two camping trips – one car camping with friends, one backpacking to Grove Creek/Battle Creek (same trail as before, but with a different campsite). Campgrounds here in Utah get booked pretty far out ahead of time, making it more difficult than we expected to find a place where we could reserve 3 sites near each other.

Mrs. Minafi and Lily tearing down our campsite The 4 of us backpacking Our campsite next to an aspen forest Adam at Battle Creek Falls Sunset over Lake Utah

Attended Vicki Robbins keynote at the Utah Jumpstart conference – which is entirely focused around financial literacy teachers. I also had the pleasure of being on a panel about FIRE with Vicki, Scott from I Dream of FIRE, and Mrs. Countdown to FI (I always assume she’s the more moderate one on Twitter). It was a quick 1-hour panel, but we covered some of the core concepts of FI (4% rule, index fund investing, lowering expenses in a healthy way). Afterwards, we got to hang out with Vicki in the lobby for a while and chat too!

Our Trip to New York!

We spent 4 nights in New York City too! Mrs. Minafi is a massive Moulin Rouge fan, and back in November, we heard they were doing a Broadway show based around the story! We booked the tickets immediately.

We’ve been racking up Chase points by churning credit cards (up to about 200,000 right now), but for this trip, we ended up using JetBlue vouchers we acquired due to a 9-hour delayed flight on our last trip to Orlando for Christmas. That sounds bad, but we knew it was delayed, so we just stayed at home until it was almost time and to go and got a free flight out of the experience!

At this point we’ve been to New York quite a few times, but it seemed different somehow. My guess is that we were different. We were less intimidated by the loud sounds, public transit and fast-pace of the city and able to enjoy it more.

We stayed with family in Brooklyn and excited went to a few new places. There’s never enough time to explore (or eat) everything we want, but we did manage to have a bunch of memorable experiences in 3 short days:

Watching the US Women’s World Cup Win over France at a Brooklyn Taphouse. You can’t get tap beer in Utah over 4% (yes, really), so going somewhere with a good local beer selection was on my list of things to do. Being able to watch the game was an added bonus!

Dinner and games with family. We had a nice dinner out to catch up, and ended up playing some games at home (Captain Sonar and Mysterium).

Having lunch and dessert with friends, including finally meeting The Luxe Strategist and Olivia from Birds of a FIRE over some deliciously hot cuisine at Szechuan Mountain House. We were able to meet up with a long-time friend of Mrs. Minafi’s over desserts at The Spot, and make our way over for drinks near the NY oddity that is The Vessel (which makes me think of Hollow Knight before I think of Hudson Yard).

Getting to see the 2nd night of previews for Moulin Rouge on broadway! This was an amazing show. I won’t spoil it, other than to say if you like the original, you’ll enjoy it. It’s an updated version too, so don’t go in expecting every song to be the same. Those changes made it all the better. There were times when the audience gave a multi-minute ovation if that’s any indication.

Going to see Sleep No More… Twice. OK, so, this was unexpected but possibly one of the most unique, memorable, amazing experiences I’ve ever been to. Mrs. Minafi and I saw it on Friday of our trip and I left confused, curious and wanting more. I booked tickets to see a 2nd showing on Sunday. Since then I’ve become somewhat… obsessed with the show – reading everything I can including all of the source material and analysis that’s out there.

“Sleep No More” is located in a massive, multi-story building in the Chelsea area of New York City on the same block as the High Line.

Trying to describe Sleep No More is difficult. My best attempt is that it’s as a Westworld-like experience, set in a 1930’s Macbeth play, crossed with Rebecca (the Alfred Hitchcock movie) where you move freely exploring the multi-story building and following characters that you can’t interact with – but they can interact with you. The music and sounds feel similar to Bioshock at times, and like you’re taking part in a modern rave crossed with a satanic summoning during others. It’s haunting, sweet, scary, chaotic, emotional, musical and most of all personal. Everyone has their own path through it, and everyone’s path is different.

Due to the high number of characters (15+) and the expansive nature of the set (it’s something like 100,000+ sq/ft over multiple floors), it’s impossible to see everything on one go. You’re also wearing a plague mask – the one thing that separates actors from guests – while not speaking for the entirety of the 3-hour performance.

To say much more would involve spoilers, but I’d for sure say that it’s absolutely worth the $100 ticket price. If you go and immediately want to go again (or go multiple times – some people go dozens of times to get the full story), you can blame me. Next time I’m in New York I’ll almost surely go back again at least once. If you do go and want spoiler-free tips on how to get the most out of the experience, here’s all you need to do:

- Find out when the show starts and line up 45 minutes beforehand. The show is 3-hours long, and everyone has a “start” time, but those times don’t matter. Show up 45 minutes before the first start time listed. That’ll all but guarantee you’ll be there the full time.

- Wear comfy shoes and eat beforehand. You’ll be moving for 3-straight hours and stopping will likely mean losing the continuity of the show.

- Don’t wear glasses. You’ll be wearing a mask for the performance which doesn’t work with glasses. Get contacts if you need to.

- Go solo. Mrs. Minafi and I stuck together for the first visit, but you should absolutely go solo and meet up at the end. There’s no talking during the show anyway, so being together doesn’t help. You’ll also have double the stories to share!

- When you enter, if you get there early and are in the first group to board the elevator, find the stairs fast and go all the way down to the bottom floor. You’ll see a bunch of characters there dancing. Pick a character and follow them for a while (and I do mean a while – give it a good hour). Sleep No More is based on Macbeth, so following him is a great place to start (he’s the one up on the Balcony that Lady Macbeth keeps looking up at). He was the most exciting character I followed and helped to better understand the story and get introduced to all the other characters.

- Read Macbeth (or watch Throne of Blood – Kurosawa’s take on the story) and watch Hitchcock’s Rebecca. Knowing the story of Macbeth helps to identify characters.

- Be ready to run! Actors run, dart into rooms, charge up and down stairs and more during the show. Stick as close as you can to whoever you’re following – even if that sometimes feels like you’re right on top of them.

To say much more would be spoilery – but you should absolutely go and experience it yourself.

If you’ve seen Sleep No More I’d love to hear about your experience! I wrote up mine, but it’s filled with spoilers, so I won’t share it here. If you share your experience and want to know mine, let me know!

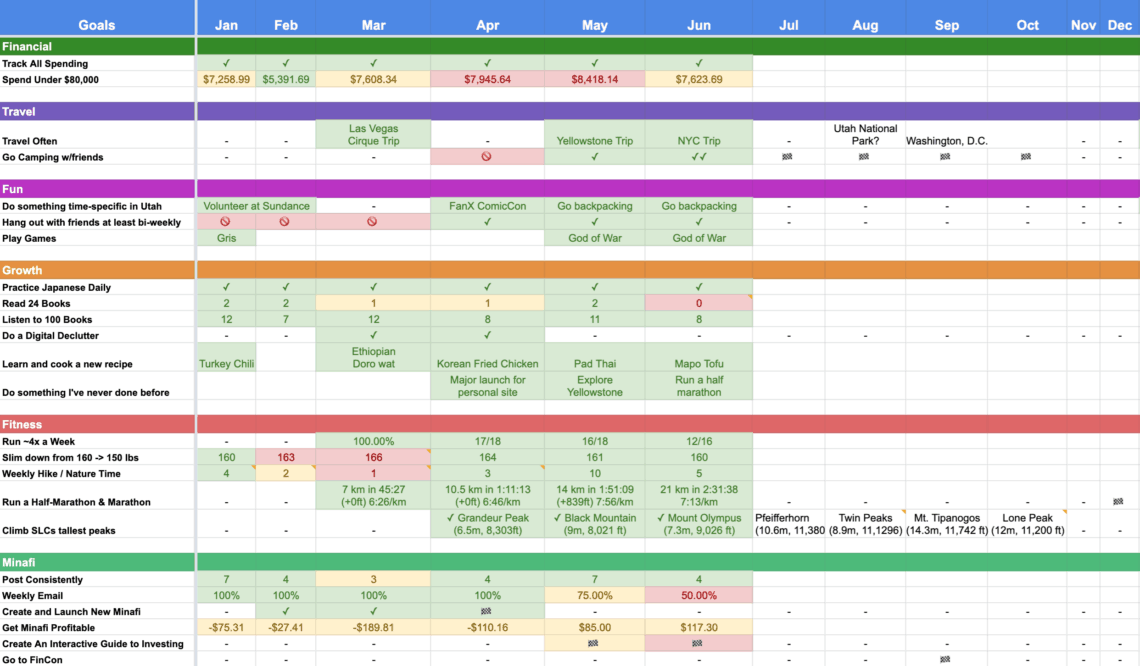

2. Goals and Progress Update

This was an exciting month. I stayed mostly off social media for the most part, which meant getting a bunch done – although none of it was here on Minafi. Instead I was running a bunch, traveling, hanging out with friends – everything listed above. I didn’t have much “focus time” though – time where I can just sit down and work on a project. I’m trying to set myself up to have more that in July.

Run a half marathon – I accomplished this one on June 26, 2019! Woohoo! This wasn’t done as part of an organized marathon, but I did hit the full distance in a 2:31:38 run over level ground. 7:13 min/km isn’t the fastest pace in the world, but it’s a good starting point. I hit a 10k run in just under 1 hour earlier, so I think there’s plenty of room for improvement. I ran 12 out of the 16 times I scheduled for myself in June – missing a few during our trip to NY, and after a 17k run where I needed more time to recover.

I’ll be running in an official half marathon, the Desert News Half Marathon, on Pioneer Day. If you’re not familiar with Pioneer Day, it’s a Utah holiday on July 24th every year that commemorates the entry of Brigham Young and the founding of Salt Lake City back in 1847. The celebration here is more massive than July 4th, with a 3-hour parade and this marathon that follows the route the early settlers took. As an atheist, I’m not exactly celebrating this for the same reasons, but I’m not going to say no to a party.

I’ve been running 4 times a week to train for this, but plan to go down to 3 times in July while also adding 2 days of weight training and one day of yoga. There’s a seriously epic climbing gym that offers all of these options I’m aiming to join. I’ve been constantly experimenting with when I should exercise and I haven’t quite solved it yet. I absolutely love waking up and enjoying coffee in bed and have no desire to start my morning with exercise. Waking up with coffee is even one of my 101 goals!

I’ve also realized when I hit it hard exercising in the morning, I feel more drained to do other things that require mental energy. I need some time to recuperate after. For now, I’m penciling a workout in around 2 PM every day after lunch.

Practice Japanese Daily – I’ve been doing a Duolingo lesson everyday which has slowly been helping my progress. Even 10 minutes is better than nothing. I have a solid grasp on hiragana and katakana now, and am slowly learning kanji characters.

For July, I’m going to switch this up and try something different. Instead of doing a single lesson a day. I’m going to aim for 10 lessons a week, where I write down what I’m learning in my journal instead. I’m realizing that i haven’t been writing enough down, and I think that’ll help solidify some of the topics. It means I won’t always do a lesson on any given day, but I should learn more overall in a week.

Explore Utah by Hiking – I went one 1 big new hike this month which I had planned ahead of time (Mt. Olympus). It’s one of the most prominent peaks in SLC, and was one hell of a hike. I didn’t do too much else in the way of shorter hikes (3-6 mile ones). I have a bunch of other longer hikes I want to try, aiming for one every 2 weeks or so. There’s still so much snow at the top of some trails that it’s a waiting game on which are accessible. I’d like to hike to the top of the Pfeifferhorn in July if the snow melts enough to make it up there.

I was aiming for one decent-length hike each week (and achieved that for May/June), but now I’m thinking I’d rather have a good focused-hike every 2 weeks instead. I like being out on the trail, but it also takes up a LOT of time and wears my body out.

3. Spending, Income, and Expenses

Our spending for the month came in at $7,623.69 – slightly above the $6,500 average, that we’re aiming for. I should note that we spend money on anything and everything right now, so there’s a lot of room to cut back if we need. This month had a few one-time purchases too:

$644 for a projector. We picked up a cheap projector from Amazon and it died after 3 months and 6 days – just long enough to where I have to go through the company warranty rather than the Amazon route. It looks like I’ll get a refund from the old one, but I did end up getting a newer, better Epson projector to replace it. This thing is awesome – we can watch shows during the day on it it’s so bright.

$530 for sporting goods. This is almost the last of backpack/camping gear purchases. The only thing left is a sleeping pad for Mrs. Minafi to use when backpacking. We picked up 2 new sleeping bags, a backpack for her and a few other things at REI’s garage sale, a firesale of returned items with some insanely good deals.

$1,004 in travel. This is actually $1,314 over the entire NY trip, but it spans into July. That includes paying for a super-nice tapas and paella dinner for our family, Lyft’s to/from the airport (it was $90 to get from JFK to Brooklyn!) and a decent amount of alcohol (~$200) during our time there.

Aside from those expenses, our spending was relatively normal for the month.

“Shopping” includes the projector and camping gear, while travel is anything remotely related to trips. “Entertainment” includes restocking some of our home alcohol collection ($300 – we mix a bunch of drinks and were out of a few spirits) and various other things – including tickets to see Playing with FIRE which made it way here to Utah!

I don’t expect July to be too costly a month for us. We have no trips planned or large purchases (aside from that sleeping pad I mentioned for backpacking). I am planning a trip for Mrs. Minafi’s birthday in August (she knows this), but that’ll be a surprise until then. 🙂

4. Current Investments

Even though my Personal Capital account isn’t connected to my investment accounts (for my own security concerns), I’m still able to use it to get a handle on my investments.

My balance at the end of June was right around $2,205,972 – up $68,293 from a month ago. May was a real downer, so seeing that recovery was a welcomed relief when I checked it just now. For the first few months of retirement I was checking my accounts almost daily, but now it’s more like monthly. My account value over the last year shifted a ton when I was mostly in company stock, but now that I’m mostly back in the total stock market ($VTSAX!) it’s been less volatile.

Overall my portfolio has been doing well – and with much less variance than the stock market as a whole. The key reason for this is diversification between US Stocks, Bonds, Cash, International Stocks and a few individual stocks (7% of my total portfolio) that are going well. I dig into this strategy a bunch in my free Minimal Investor Course which shows this simple way to invest. If you want to see how I invest – and more importantly why – this free course if for you.

As for asset allocation (which is what makes this all possible) here’s what that looks like now.

We’re holding a bit too much cash right now, but part of that is because we have a $100,000 tax bill coming due soon (?). After that, we like the idea of having cash reserves that equal:

- 6 months of our joint expenses in our join account.

- 1 year of individual expenses in each of our own personal accounts.

The second one is very much for peace of mind and also personal autonomy. While Mrs. Minafi and I are on amazing terms, and just celebrated our 13-year anniversary (17 years since we met), I would want us both to have access to our own cash should the worst happen. “The worst” could mean a lot of things – joint accounts gets frozen, one of us passes and can’t access the others for a while, a bad break up causes a financial fight. However unlikely, I want us both to be in a stable financial position should any of these things happen.

5. What’s Next?

For July we’re staying mostly close to home – maybe a backpacking trip out at some point but nothing too crazy. That should make for a great reset after our NY trip. I’m planning an August birthday trip for Mrs. Minafi that I’m excited about too!

Lately, I haven’t felt like I’ve made enough progress on the areas that I most want to focus on. With that in mind, I’m changing things up a bit for July. Rather than focusing on a ton of individual habits, I’m going to focus on a small number of high-priorities. This follows the Buffett 25/5 technique rather than concentrating on tons of habits.

What this means is that some of the things I’ve prioritized doing won’t be things I’ll worry about. In my jobs, the times when we usually got the least done is when we tried to get the MOST done. Often the answer is to regroup, refocus down to the essentials and focus on those.

For me, the ones I laid out when I left my job were mental health and physical health. I’m extremely glad I focused on these over getting something done. Putting these as priorities 1 & 2 is more than just for my own health – it helps me be a better husband, a better friend and lays the groundwork to be better for the rest of my life.

To help with this, I tried doing Buffett’s 25/5 technique again. It was helpful to look at things with a clear mind and refocus. After listing out 25 items, I sorted them by priority and came down these 4 being the most important. I took one more step and tried to list out what I could do

- Plan Mrs. Minafi’s birthday trip

- Figure out dates and book hotel

- Find additional unique things to do

- Decide on a few highlights & where we’d be each day

- Write the Interactive Guide to Investing

- Work in the mornings when I’m most productive (before noon)

- Stay off social media before noon (stealing this from Thriftygal)

- Program stand-alone interactive elements at night on CodePen (while learning new things)

- Write my presentation for FinCon

- Create a draft list of the topics

- Reach out to people who I want quotes from

- Reach out to FinCon to see about a slide template

- Order a clicker for presenting (lost mine :/)

- Focus on personal fitness (running, hiking, weightlifting, etc)

- Set a time for fitness – 4pm every day is fitness time!

- Set a schedule – M=running, T=weights, w=running/hiking, R=weights, F=running, SS=running or weights

- Track food intake via Fitbit

- Limit alcohol by not drinking 2 days in a row

If there’s one theme I have for July, it’s focused fun. I’m not trying to pin myself down to work, but I do get enjoyment out of exercising and working on programming projects. I want to make sure I’m creating that space to feed those healthy habits – and that’s one thing I want to do more of in July.

How was your June? Did you get outside, or explore? What do you have planned for July?

Sebastian

July 8, 2019

It’s always a delight to read your monthly updates. Thanks for keeping us up to date! Makes me excited for my own early retirement some day 🙂

Adam

July 9, 2019

Thanks man! Glad to hear they’re not falling on deaf ears. 🙂

allendave

August 6, 2024

Recording success in Cryptocurrency, Bitcoin is not just buying and holding till when bitcoin sky-rocks, this has been longed abolished by intelligent traders ,mostly now that bitcoin bull is still controlling the market after successfully defended the $60,000 support level once again and this is likely to trigger a possible move towards $100,000 resistance area However , it’s is best advice you find a working strategy by hub/daily signals that works well in other to accumulate and grow a very strong portfolio ahead. I have been trading with Mr Bernie doran daily signals and strategy, on his platform, and his guidance makes trading less stressful and more profit despite the recent fluctuations. I was able to easily increase my portfolio in just 3weeks of trading with his daily signals, growing my $3500 to $65,000. Mr Bernie’s daily signals are very accurate and yields a great positive return on investment. I really enjoy trading with him and I’m still trading with him, He is available to give assistance to anyone who love crypto trading and beginners in bitcoin investment ,he can also help you recover your lost funds I would suggest you contact him on WhatsApp : + 1424(285)-0682 , Gmail : ([email protected]) or Telegram : @IEBINARYFX for inquiries

Nevada Smith

July 8, 2019

If you wish, a comment that I like is from Morpheus of the Matrix. “There’s a difference between knowing the path, and walking the path”. You may or may not want to use for FINCON (of which I am attending as well). All the best, Nevada

Adam

July 9, 2019

That’s a great quote! I’ll keep it in mind. If you want to meetup at FinCon I’m 100% down for it.

David

July 11, 2019

Appreciate the monthly updates! How do you decide what % of Cash vs Bonds in your asset allocation? VBTLX has an Estimated SEC yield of 2.5% but high yield savings accounts can offer a Guaranteed 2.2%. Also cash is more liquid and won’t drop in price like bonds. Thanks!

Adam

July 15, 2019

Good question. Now a days bonds don’t have the returns they once had – that’s for sure. Our bank account has a 2% interest, so comparing it straight out to bonds today is pretty much flat.

What I like about bonds is that the price of bonds tend to go up when stocks go down (and still go up slightly overall). That diversification helps lower the swings in my portfolio slightly more than just cash. Over the last year, for example, $VBTLX’s value went up about 4% with another 2.5% in dividends. I wouldn’t expect that most years, but it does seem to outperform cash over the long-term. That makes sense though, since it holds a bunch of US treasury notes (42% of the holdings) that are basically getting the same rate as cash + some corporate bonds (26%) that are higher risk/reward.

I’ve considered switching to something like Vanguard High-Yield Corporate Fund Admiral Shares $VWEAX, but that fund tends to correlate more highly with the stock market – so when one goes down they both do without the advantage of diversification.

I’m still figuring out how much to hold in cash vs bonds though. Right now my target is to have 1 year of spending in our joint account, 1 year in my cash account and 1 year in my wife’s cash account (so 3 years of spending in cash, getting that 2+% interest). We’re trying to put more into cash/bonds now (targeting around 35%), but plan to ease that back down to closer to 20% over the next 3 years. For the long-term all of the projections (Big Erns for example) favor more in stocks for sure.

Joe

July 19, 2019

Hi Adam,

Enjoyed reading your monthly update. You didn’t pay estimated taxes in June? I’ve been early retired for 11+ years, and taxes are always my biggest expense. I’d think that especially in the first year of retirement, there would be a bunch of stock sales to diversify or reallocate assets properly. If you end up owing a big tax bill in April and didn’t pay estimated taxes throughout the year, they tack on a lot of interest and penalties…

Adam

July 22, 2019

Great point Joe! For a moment reading this I had gut-clenching response, then I remembered why I didn’t pay estimated taxes in Q2.

2 reasons:

My wife is still working, so we’re not continually selling assets.

All the assets we did sell were in Q1, and I paid estimated taxes in Q1.

This is a good reminder though that I’ll probably have to do that in future years. I’m not at all used to paying estimated taxes, so I’ll need to get used to doing that in the future.

Joe

August 2, 2019

You mentioned in this update that one of the reasons you’re holding $300k in cash is because you have an upcoming tax bill of $100k. So I was confused why you would have a $100k tax liability and not have paid estimated taxes, I’m still confused but will leave it for you to figure out. I have my own tax forms to worry about… lol

Adam

August 4, 2019

Ah yeah that’s a good catch! I have a feeling I won’t owe quite that much tax – since I did pay $12k in estimated taxes for Q1 already – and that was the period when I sold most everything. I should revisit this to double check the tax liability is what I presumed it would be. It sounds like it’ll be considerably less after all, which would be a reason to move more to stocks.

Janet

September 8, 2019

Happy belated to Lily! Cute pics! Hope FinCon was a blast 🙂