Every month I share a quick recap of what happened over the last 30 days. In these posts, I share a bunch of details – what’s going on in my life, progress towards goals I’m working on, a breakdown of our spending over the last month and a look at our investments.

I absolutely love reading this kind of insight for others. It was one of the things that started to make it clear how people go about retiring early. My hope is that others will get equal value from my takeaways.

- What’s new with me?

- Goals and progress update

- Spending, income, and expenses

- Current investments

- What’s next?

I learn a lot about myself through journaling – taking time to put into words how things are going and reflecting on them. If you write something similar each month, feel free to share it in the comments – I love reading them.

Here’s a look at some previous updates:

- March 2019 Update

- 2018 Q4 Winter Investment Report

- 2018 Q3 Fall Investment Report

- 2018 Q2 Summer Investment Report

- 2018 Q1 Spring Investment Report

- 2017 Q4 Winter Investment Report

- 2017 Q3 Fall Investment Report

Since leaving my job at the end of 2018, I took 2 months off, then started writing these monthly.

1. What’s New With Me?

After spending a long weekend in Vegas during March, April felt like a very low-key, relaxed month. Mrs. Minafi traveled some for work, but I kept myself busy at home.

This month truly felt like a relaxed, retirement life. From our Vegas trip to mid-April, I don’t think I traveled more than 5 miles from our apartment (maybe not more than 2 miles actually). That will either seem boring or like gloating, but I ended up staying very close to home all month.

Most days started with waking up when our dog Lily needs to go outside. I’ve replaced an alarm clock with an even more urgent timer. She consistently wakes me up before 8:30 AM, regardless of anything else going on in life.

Most of my mornings start the same:

- Wake up and walk Lily by 8:30 AM (if Mrs. Minafi doesn’t walk her first).

- Have coffee with a Cliff Builder Protein Bar in bed. (We buy these in bulk from Costco).

- Read a page of wisdom from The Daily Stoic.

- Read some in bed. (I’m currently reading a copy of Seven Years in Tibet we picked up at a bookstore in Inverness, Scotland).

- Go through my inboxes – reply to all emails, catch up feeds of other blogs on Feedly, respond to Minafi comments.

- Complete a Japanese Duolingo lesson.

- Plan out my timing for the rest of the day.

This has been my goto morning routine. It takes about an hour or two, and by 10 AM I’m ready to move on with my day. Since my digital detox last month, I cut out a few others parts of my morning route – checking Twitter/Facebook/Reddit/Instagram. By doing that I was able to “complete” this series of morning activities (many have tried, but you can never “complete” Reddit).

I usually have an idea of what I’ll be doing later in the day (ie: go for a run, write a post for Minafi, get groceries, etc), but it all happens after that morning routine.

This isn’t set in stone. Depending on how I’m feeling I might change this up and skip part of it. If I have an idea I want to write about or a programming topic that’s on my mind, I’ll skip reading or learning and just do that.

The rest of the day usually consists of going for a run or a hike, running any errands we need, and getting in some focused time (writing or programming) after lunch. We’ve been trying to make large portions of food to have leftovers, so some days round out with preparing a large meal for dinner.

FanX – Utah’s Comic-Con

April also saw some fun activities! Mrs. Minafi and I spent 2 days wandering around FanX Salt Lake City – Utah’s version of Comic-Con. As an added bonus this event is about 4 blocks from our apartment.

We’re both lifelong nerds who grew up going to comic and anime conventions every year. That’s not stopping just because we’re in our mid-30s!

We didn’t dress up, but we did spend our time there admiring the amazing costumes, going to interesting panels and browsing the massive dealer’s room.

We also sat in on a bunch of interviews – voice actors of Aladdin, Jasmine and Pocahontas, John Cleese (Monty Python), Mike Colter (Luke Cage), Tom Felton (Draco Malfoy) and Brandon Sanderson, one of my favorite authors., just to name a few. We sat in on some other panels on various topics – How Twilight Zone is Awesome, how Steve Ditko isn’t given the credit he’s due in Comic History, and a look at the best new anime of the last year.

Voice actors for Aladdin, Jasmine and Pocahontas. Dim Sum from a food truck! Pins in the dealers room Cute Pins for my backpack That’s No Moon Sticker

Cherry Blossoms in Bloom

For 2 weeks in April, all of the cherry blossoms and plum blossoms are in full bloom here in Salt Lake City. The best place to see them is at the Utah state capitol building, which has 433 trees in a 1km loop around the building. We joined the tourists and Instagramers posing for pictures in front of the beautiful scenery.

Lily tired out Beauty Everywhere The Path Around the Capitol A view of the Capitol Building

It was a seriously beautiful sight to see. After being in Japan for cherry blossom season twice, it was great to have a chance to see blooms within a mile from our home.

2. Goals and Progress Update

A few weeks ago I shared a few of the goals I’m working on and how I’m organizing them. Many of these I’m just getting started on, but hey, I have to start somewhere.

Starting this month, I decided to organize things I’m working on a spreadsheet (because why not, right?).

Whew, that’s kind of a lot. I’ve found that I am happiest when I’m setting ambitious goals and making trackable progress towards them. Goals like “run more” do nothing for me, but if I set a goal like “run a marathon” and then set the habit that’s needed to get there, I’ll feel a sense of accomplishment as I work towards it.

I won’t go over every single item on this list since some of them are pretty straightforward. This is a first attempt at trying this type of goal setting, so we’ll see how it works over time. Whenever I try something new there’s a period where I’m more productive, then that evens out. Time will tell if this helps or if it’s just another exercise.

1. Run a Marathon

In April I ran 17 out of the 18 times I set out for myself – not too bad! My longest run was 10.5km (a quarter of a marathon) in 1:11:13 (6:46/km pace). This was the longest distance I’ve ever run in my entire life, so just completing it was a huge win.

For the month I ran 117 km total or 72 miles. I grew up with asthma and was usually last in my class when we had to run a mile. I’ve always had a limiting belief at how much I could run due to that condition. The biggest impact of running is that I’ve felt stronger, I’ve been able to stand longer and I was able to hike longer.

Ultimately the reasons I want to run a marathon are partly personal challenge and partly to increase my general endurance. I want to increase my personal grit and be able to withstand longer workouts, hikes and anything else that comes up. Being able to exert myself for multiple hours helps many things!

2. Continue Work on Minafi

I launched Minafi v2 finally this month! This update includes a bunch of new updates including a few I mentioned on Twitter:

It has been sooo much fun working on this over the last ~3 months. There’s something cathartic in putting into practices ideas and seeing them in action. I’ve worked at ed tech companies for the last 8 years, so being able to put into practice a number of things that I’ve seen work there (or things I always wanted to try) have been fun.

This release wasn’t a usual product launch where the goal is to get thousands of eyes on the site. Instead, it helps set up a site that I can build on and is more about creating a great playground.

If you’re curious about the technical details, check out “How Is This Site Built?” post that details how I’m using Ruby on Rails, Vue.js, Tailwind.css, and WordPress together to build this site.

Now that the basics are in place, I’m looking forward to writing more, creating more interactive content and just seeing where this all goes. I enjoy the challenge of growing a site and have way more things I want to try than there is time to do it. I see why so many young retirees start blogs – they’re an endless void of action if you want to spend your time there.

3. Focus My Time on What Brings Joy and Value

This one is a bit more ambiguous. It’s more of a catch-all for everything else I’m working on. Here are a few updates on what’s working and what isn’t.

Learn Japanese – A+ – Practiced Japanese all 30 days of April using Duolingo. Slowly but surely progressing! I’ve recently started a journal where I write out what I’m learning each day. The idea isn’t to review these terms, but more to get experience writing and reinforce what I’m learning.

Digital Declutter – A – After reading Digital Minimalism, I went a month without using Facebook, my personal Twitter, Reddit or Instagram. I wrote a detailed post about that experience so I’ll skip reiterating it here, other than to say it was beneficial for my mental health and I’m very glad I did it. My phone usage has changed dramatically too.

Cook a new dish – A – I’m trying to learn a new dish every month. Not just cook it once but learn it and be able to recreate it without looking at a recipe.

For this month I focused on Korean air fried chicken. This is one of my favorite dishes and we’ve had it all over – most recently at Pok Pok and Best Friends in Las Vegas. I tried a recipe that worked great and had a tasty Gochujang sauce to coat the wings in. I tried this recipe a few more times with regular chicken thighs and it was just as tasty.

Go for a hike every week – C – It’s finally warm enough to hike here in Salt Lake! Up until mid-April, most trails were still covered in snow. Now they’re mostly clear until you get above 7,500 ft. I’ve picked out a bunch of hikes I want to do all around Salt Lake – including some of the tallest peaks, most scenic lakes, and popular trails.

For April, I hiked around Red Butte Gardens and had a lot of fun hiking up to Grandeur Peak – one of the lower peaks surrounding Salt Lake City. At the end of a 6.5-mile trail and at an elevation of 8,301 ft, you can get an amazing view of the city. I’ve found that any trail along the valley gives great views – even without climbing all that high.

Last hike up Mountains to the south Mountains and the City Salt Lake City from Grandeur Peak Me squinting at the top

Play more games with friends – F – We didn’t end up having any game nights this month. We’ve been hanging out with friends for lunch and getting together every Sunday to watch Game of Thrones, but sadly games have been lacking. After GoT wraps up in a few weeks I’ll try to start something up.

Settle into our apartment – C – Our apartment continues to look more moved into. Having friends over is the best way to force us to clean things up. I planned to do some decluttering this month but didn’t make the time for it. We did introduce a few new plants and frame a few pieces of art we picked up at FanX though.

3. Spending, Income and Expenses

Our spending for March came in at $7,945.64 for our household of two. Here’s a breakdown of what that looks like so far this year.

| 2019 | January | February | March | April |

|---|---|---|---|---|

| Home | $2,162.48 | $2,138.81 | $2,078.40 | $2,262.65 |

| Food & Dining | $1,190.02 | $1,089.12 | $723.66 | $1,114.60 |

| Travel | $1,160.64 | $0.00 | $2,155.08 | $482.81 |

| Personal Care | $179.51 | $73.45 | $212.88 | $348.80 |

| Entertainment | $495.58 | $295.95 | $698.70 | $854.33 |

| Bills & Utilities | $433.95 | $217.82 | $486.49 | $263.53 |

| Auto & Transport | $395.88 | $84.90 | $189.76 | $174.90 |

| Shopping | $380.29 | $843.36 | $219.67 | $1,902.62 |

| Pets | $181.36 | $166.64 | $266.02 | $97.00 |

| Health & Fitness | $59.49 | $15.75 | $345.78 | $13.00 |

| Total | $7,258.99 | $5,465.14 | $7,821.22 | $7,945.64 |

Our 3 biggest expenses were $2,137.75 (27%) for our apartment (rent, utilities, insurance, internet), $1,650 (20%) on a vintage Chanel purse Mrs. Minafi has been eying for years (and thinks she can recondition and increase the value of), and $1,119 (14%) spent on food.

A full 54% of our spending was on travel and our apartment. Considering we didn’t travel at all in February, and have relatively few travel plans this year (Yellowstone, camping, NYC & FinCon), we’re not worried about this.

If our spending for this quarter continues, we’ll spend $84,613.98 for the year – which is slightly above our $80k target.

This spending is way higher than most finance bloggers out there. Apparently, we have “expensive” taste! There are a few reasons why our spending is as high as it for now:

Home – $2,262. Outside of our mortgage, we also picked up some plants for our balcony, artwork for the walls and a few general supplies. We’re OK spending a little more on housing right now. That allows Mrs. Minafi to walk to work and for us to have a great jumping off point around Salt Lake.

Shopping – $1,902. This was a large shopping month, with the big purchase being Mrs. Minafi’s vintage classic Chanel Matelasse Classic Flap Small bag ($1,650). We trust each other to make our own financial decisions, and I know she researched the hell of this before making a purchase. Apparently, there’s a lot to research! You have to make sure it’s authentic, research the quality, and potentially have it refurbished or cleaned. I tend to think her purchase will hold value longer than anything I buy. Outside of that, we picked up a few things at FanX, but that was about it.

Entertainment – $814. I continue to be amazed by how much we spend on this category. This includes $457 spent on alcohol – for home consumption, parties and at bars. The rest includes $263 some concert tickets we bought for later this year and the rest for movies out and various online services.

Food – $1,119 – This comes out to $611 groceries and the rest for restaurants (including buying some lunches and dinners out). This is in line with our spending in past months. I have a feeling this will go down as we learn how to cook more of the dishes we love at home.

One unexpected thing this month is that my personal spending went down to only $115 – which included some purchases at SLC’s Comic-Con, domain names, and a haircut. I’ve yet to buy any clothes in the past 5 months since leaving my job.

Income

I didn’t make any income aside from a few bucks here on Minafi from the occasional referral. Minafi isn’t profitable, so I try to separate it out from our personal household spending and income. Those numbers are updated every month on Minafi’s Income and Expenses page.

Mrs. Minafi is still working, which provided some much-needed health insurance and additional income (much of which goes into her 401k).

All things considered, our withdrawal rate from savings was on pace to be about 2.6% based on this months spending, or 1.6% as our withdrawal rate so far this year. Considering we’re targeting a 3.5% withdrawal rate, I have no worries about currently spending 1.6%. If Mrs. Minafi wasn’t working, we’d currently be withdrawing 4.48% for the month, or 3.85% so far for the first 4 months. That cost doesn’t include healthcare, so maybe add another 0.5% to it for that.

In other words, we’re good now. If Mrs. Minafi did stop working tomorrow, we’d need to make some changes to drive our spending down a bit or add side income if we wanted to stay under 4%.

4. Current Investments

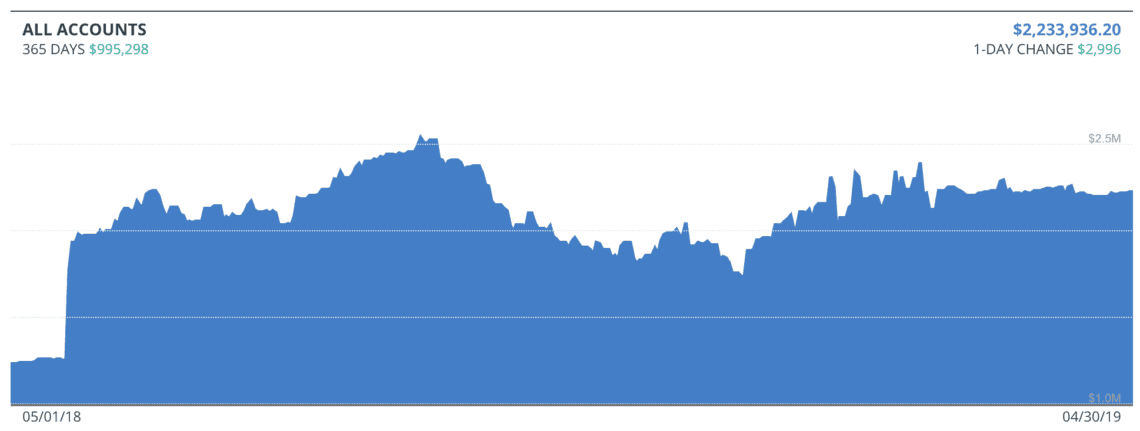

In the past, I’ve usually listed out each and every investment here, which was quite a chore. I’m going to take a shortcut and using some screenshots from Personal Capital instead!

Our investments ended April at a value of $2,225,984.00, which is down $13,246.00 from March. The market was up in April, so losing $13k seems like a lot.

The reason our balances went down is that we paid $67,600 in taxes (!!!!!) for 2018 and Q1 2019. This goes back to paying off capital gains from selling a ton of IPO stock.

Of that $2.2m, another $75k is earmarked for taxes in 2019. We’ll pay estimated taxes throughout the year while it earns 2% in a high-interest savings account.

What’s awesome about this situation for us is that if markets hold steady and we pay our taxes, by next year we’ll have about $1,900,000 in brokerage accounts with a tax basis of $1,600,000 (!).

In other words, 84% of our after-tax investments will be covered. This is part of the reason we don’t expect to pay much tax going forward. At that point, if we sold $100,000 in stocks, only $16,000 of it would be considered capital gains and be taxable. If that was our only income for the year then our tax bill would be $0.

Starting in November I began selling some shares from the IPO. I continued selling them a little each day for the next 3 months – into February 2019.

Those spikes are Personal Capital not knowing what to do about having money in multiple accounts – selling funds on one brokerage, transferring it to my bank, then transferring it to Vanguard.

Our monthly investment balances over the last 4 years have been a constant march upwards with a welcomed bump last year.

The big jump in November is when I formally got access to the IPO stock. If I had sold it all in December then that’s where the line would have remained, but luckily for me I dollar cost averaged the sale and it got me an extra $200,000.

If I had waited even longer than it would have paid off even more. In December the stock had fallen from $37 at its peak to $19 – and it could just as well have fallen to $10. $PS is back up to $34 today with an analyst price target around $41. I’m not planning to sell any more stock this year, but likely will in 2020 in order to pay taxes on them in the new year.

Besides that IPO stock (which is in the speculative row on this chat), here’s a breakdown of where our money is invested on the left and our target allocation on the right.

As far as individual stocks go, each non-header row should correspond to one index fund. That’s not the case though since this spans multiple accounts.

For example, take “US General”. In my Vanguard account, I invest in $VTSAX. Likewise in Mrs. Minafi and my shared Vanguard account. In Mrs. Minafi’s 401k through Fidelity, she’s in an S&P 500 fund because that was the equivalent fund with the lowest fee. For this chart, I combine all of those into one “US General” category that spans all accounts.

If you’re curious about how I decide which funds to pick for each of these categories, check out my free Minimal Investor course, which shows how to evaluate ETFs and make decisions for yourself on what to invest in.

The biggest area that’s out of target for our accounts is international funds. We still have a lot of cash right now, so future investments will go into an international fund. That should fix itself over time as $40k moves over there to start. I may also sell some US Stocks, which I accidentally let automatically invest and throw off our allocation. Luckily those were only recently invested so they won’t have much in the way of capital gains to worry about.

5. What’s Next?

I always like May. It was the end of the school year, a time to plan summer breaks and most importantly – my birthday! (I’ll be 37). May should be a relatively quiet month around here. We have a trip to Yellowstone planned for my birthday (which we can drive to!), but other than that we’ll be hanging out here in town.

For the most part my May will consist of continuing to do what I’ve been doing:

- Keep running, following the RunKeeper Marathon training plan.

- Continue practicing Japanese daily.

- Hike the Mount Olympus Trail and Fifth Water Hot Springs Trails.

- Increase writing on Minafi to 2x a week. (aiming for 1 personal/life post, 1 SEO/popular topics post).

- Explore Yellowstone during our 4 nights there.

- Start tracking calories I eat and setting a threshold. I somehow gained a few pounds by grazing for food all day long.

Other than that, continue getting the hang of being in control of my time, staying off social media (most of the time) and embracing new challenges!

How as your April? Do you have any plans or goals for May?

Joe Bios

May 7, 2019

Hello Adam,

It’s great that you track your portfolio. However, you might think about the goals for the portfolio. Do you plan to spend it down or grow it over the next 48+ years? Keep in mind every current $ you can direct to your investments will have almost 50 yrs to compound! So you might want to assess your current budget with this in mind. Also, with a 50 yr timeframe you can probably invest more aggressively as long as you maintain a cash reserve for market downturns. The 20% bond allocation or 10% REIT allocation in your current portfolio doesn’t make much in this context unless you are in spenddown mode and need income. You also should consider some context for the often quoted 4% rule. While it is conservative: 1) it’s based on a 20 yr retirement not a 48 year dual-life retirement; 2) it’s based on not running out of money during the term (a spenddown scenario); 3) coming anywhere near running out of money late in retirement is a pretty severe consequence since your expenses are likely to increase in your final years. You might want to run some projections to see how well your portfolio will perform given your current expenses and anticipated sources of income in the future.

Adam

May 7, 2019

Hey Joe!

You’re right on the timeframe – it’s a long one. Using traditional 30-year projections aren’t going to cut it, so it makes sense to be more aggressive.

That’s a good idea for sure. I like the idea of making our portfolio more aggressive before too long. 20% bonds and 80% stocks is still pretty aggressive though! From the simulations I’ve run, the differences between that and 100% aren’t too much, but then it decreases the swings significantly.

I also worry that right now stocks are overvalued and in for a swing. Having that happen now would be about the worst timing for us – although we do have cash to last a few years.

Looking at the Shiller PE Ratio, it’s higher now than in any other time except during the tech boom in the late 1990s. While I wouldn’t invest completely based on that, between that, us switching from savings to spending and a market ripe for correction, we’re aiming to hold back a little for now. I like the idea of eventually getting back into a more aggressive asset allocation though – but with it being over about 3-5 years.

If you were suddenly retired today, how would your asset allocation look? Would it change over time?

tawcan

May 8, 2019

Do you find Duolingo pretty good? Maybe that’d be a good way for me to learn some Danish.

Digital declutter is really good IMO. I had to factory reset my phone the other week and I haven’t installed that many apps on my phone yet. This simple gesture makes me spend less time on my phone. 🙂

Adam

May 9, 2019

I’m a big fan of Duolingo – but you do only get out what you put into it. If you spend 15 minutes a day that’s not going to add up too fast, but it will be forward progress. Keeping a streak going has been a good incentive for me to keep spending some time every day.

That’s a good way to approach it! Just not installing new apps after a reset. For me, not having those apps on my phone became the new normal after a very-distracted week picking up my phone and realizing I couldn’t open Twitter on it. -_-

Lazy Man and Money

May 12, 2019

My kids and I are on our third week of learning Japanese on Duolingo. They’re obsessed with Pokemon, so it was largely their idea. At the ages of 5 and 6, I don’t know how long this enthusiastic curiosity will last, but I’m going to run with it.

We’re also doing French lessons because their school starts that at Kindergarten, and whatever they can learn early is a bonus.

Adam

May 21, 2019

Wow, starting learning a language at that age would be amazing. If you can find a project they enjoy to continue that curiosity, that’s a skill they could have for life!

allendave

August 6, 2024

Investment is one of the best ways to achieve financial freedom. For a beginner there are so many challenges you face. It’s hard to know how to get started. Trading on the Cryptocurrency market has really been a life changer for me. I almost gave up on crypto at some point not until saw a recommendation on Elon musk successfully success story and I got a proficient trader/broker Mr Bernie Doran , he gave me all the information required to succeed in trading. I made more profit than I could ever imagine. I’m not here to converse much but to share my testimony; I have made total returns of $10,500 from an investment of just $1000 within 1 week. Thanks to Mr Bernie I’m really grateful,I have been able to make a great returns trading with his signals and strategies .I urge anyone interested in INVESTMENT to take bold step in investing in the Cryptocurrency Market, he can also help you recover your lost funds, you can reach him on WhatsApp : +1(424) 285-0682 or his Gmail : [email protected] tell him I referred you