Is $ARKK Worth The Fee?

ARK Innovation ETF ($ARKK) is an active equity ETF created in 2014 that invests in companies poised for “disruptive innovation” by introducing a new technology that is yards ahead of their competition.

Minafi categorizes $ARKK as a Healthcare fund based on its largest focus (31.5%). It also invests in Information Technology (29%), Consumer Services (21%) and another 20% split over other categories.

Some companies that $ARKK invests in include: Tesla, Roku, Square, and Spotify. Each of these companies is the industry leader in their field and posed to see their market share grow (or at least that’s $ARKK’s hope). If you’re investing in a Total US Index fund like $VTSAX, you’ll also be invested in these same companies – but in a much smaller amount.

According to the funds official page, they focus on companies that are aiming to disrupt any of a few areas:

Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘‘Genomic Revolution”), industrial innovation in energy, automation and manufacturing (‘‘Industrial Innovation’’), the increased use of shared technology, infrastructure and services (‘‘Next Generation Internet’), and technologies that make financial services more efficient (‘‘Fintech Innovation’’).

ARKK Official Information

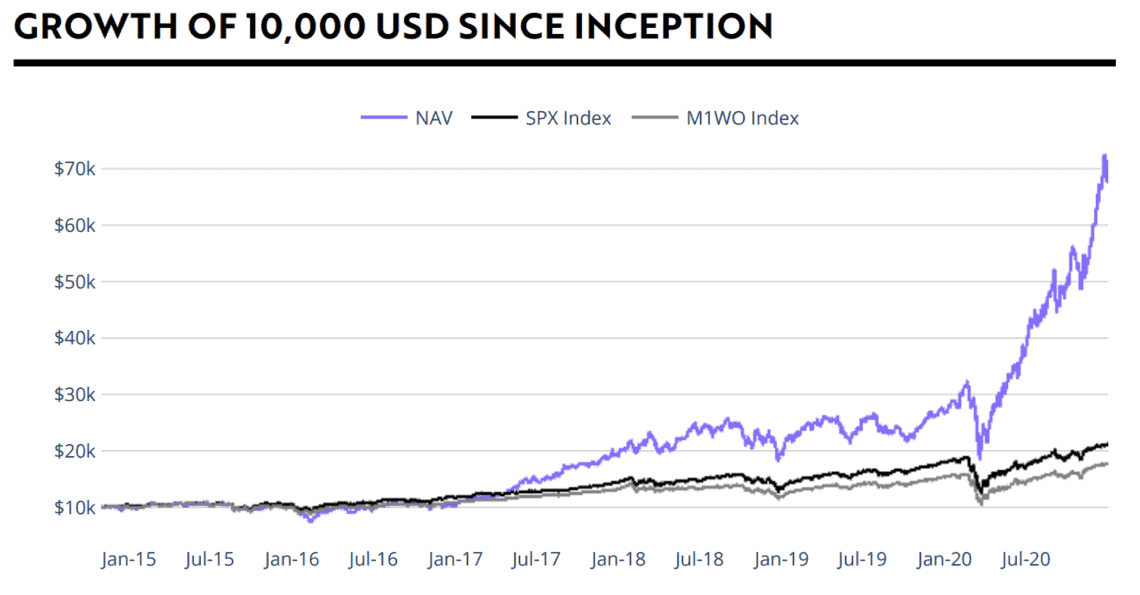

So is it worth the fees? Since it’s an actively traded fund, it’s no surprise it has higher fees than passive index funds. At 0.75% it’s still priced lower than similar funds.

$ARKK invests in a very small number of funds – only 48 (as of February 3, 2020). The top 10 funds make up 48.5% of the funds’ value. You could manually invest in those funds without this fee – but it would take much more effort on your part.

Will this trend continue? It’s unlikely. One reason why you see $ARKK shoot up since 2017 is due to its investment in Tesla in a year when it increased more than 600% in that year alone. Technology companies have been on a rampage upwards lately fueled by COVID and breakthroughs in machine learning enabling technologies that were impossible only years before.

If you’re investing for retirement in The Minimal Investor way, this fund will be much higher risk and higher reward than most of your portfolio. Keep that in mind when deciding how much (if any) of your portfolio to invest in $ARKK.