For the last 12 years, I’ve been investing. I have a course on investing, I share what I’m invested in every quarter and even detail the ideal way I would (and do) invest $1 million. Writing and talking about investments, one of the most common questions I hear from people just starting their journey is the same:

Note: I started an experiment using Wealthfront and Betterment in January of 2018. This post includes details on both, as well as a look back at how they did in their first year.

What do you think about robo-investors?

In the first year of writing here on Minafi, I don’t think I’ve heard any question as many times as this one. There’s a lot that goes into an answer to this question. This is the first post in a series that will try to answer this question based on where YOU are in YOUR life. I would recommend robo-advisor, but not for everyone in every scenario. This post (and series) attempts to answer the question: Which should you use?

The choice to invest with anyone is a huge a decision, and if you’re reading this then you likely realize that.

I remember the first time I put $3,000 into a Vanguard account. My heart was in my throat. I was completely scared that I’d entered something incorrectly and I was just going to lose that money. If you’re new to investing, and you’re feeling any kind of dread about investing, I’d encourage you to BREATHE. Step away from the computer, get some fresh air (and come back too please!).

The Plan

The hope is that after reading this guide, you’ll have a much better grasp on the role robo-advisors could play in your investing journey – whether you choose to use them or not.

- My Experiment

- Types of Investing and Advisors

- Picking an Investment Strategy

- Comparison of Returns After One Year

- My Recommendation

My Experiment

I’m doing an 11 month trial of using Betterment and Wealthfront. For both, I invested $10,000 of my own money on January 3, 2018, and will hold whatever investments they tell me to until sometime in December 2018.

For each month, I’m going to dive into different aspects of the services, compare them and share my takeaways.

Robo-advisors aren’t something I personally use (favoring Vanguard Index Fund Investing instead), but I have always been curious about them. Could I save money by using their tax loss harvesting feature? For someone new getting started investing, should they consider going the robo-advisor route? Why or why not?

One thing this isn’t is a referendum on which service can make the most money. Betterment and Wealthfront have a slightly different asset allocation based on their risk assessment of me (Wealthfront choose a portfolio with 9% bonds, Betterment choose 36% bonds), so the returns are going to be different. I’m hoping to understand which has the potential to make the most money long-term for someone who’s just getting started. This involves comparing these two services on a number of different categories:

- Fees – How will fees impact your long-term plans?

- Tax-loss Harvesting – How much value will this feature bring?

- Usability – Do their tools help make it easier for a beginning investor?

- Education – Do they make it clear what they’re doing?

- Trade-offs – Are they worth it to you compared to self-managed investing?

Why January to December? When filing taxes, you need to list out every account you own. I’d rather only need to do this for one year rather than twice.

Being a Beginner Investor

Being a beginner investor is tough. If this is you now, I don’t envy your position. Everyone is looking to make money from you. It’s a tough terrain to tackle to find trustworthy advice that can actually help. I’ll be clear about my potential benefits – I have no affiliate programs with Betterment, Wealthfront or Vanguard. If you choose to use any of those services, I won’t get a dime.

I do have a course on investing, The Minimal Investor, so I do have a financial reason to recommend you learn how to invest. That being said, I do think that depending on your situation, timeframe, and many other things that robo-advisors could be the right choice for you. (more on that later on this post).

When I was beginner investor, I worked with a financial advisor at my bank. It was nice having someone to talk to in person and ask questions to. What wasn’t nice was that he charged a 1% fee, and then choose a number of other investments for my money that also had a 1% fee or higher. I would have LOVED to have chosen either of these services rather than an advisor from a fees standpoint.

Even with these fees, I was learning a lot! Understanding the core concepts behind a good portfolio from an advisor who makes them initially can be extremely helpful in getting started. This is something you can learn from Betterment or Wealthfront – letting them choose what to invest in, then spending the time to understand why they made those choices.

My hope is for you to find something you’ll feel confident investing with. If you can do that, then it becomes easier to deposit money every month. You don’t have to constantly worry if you’re putting money into a safe place, because you’ll know it’s a safe place.

Don’t Buy Into the “We Can Beat the Market” Myth

Financial advisors (which I’m not) are one of the most confusing spaces. Almost every one I’ve talked to has mentioned how they can “beat the market”. This is just not true. If anyone ever says they can beat the market, I’d encourage you to RUN. It’s not that it’s impossible, it’s that odds are not in their favor. It’s easy to beat the market when every fund is going up – you just invest in more risky funds.

The difficult part is beating the market during a downturn. Today, in 2018, we’re in one of the longest stock market runs in American history. The riskier your portfolio is, the better you may have done during this time. When (and it’s when not if) the market takes a downturn, will these advisors be able to still “beat the market”? I tend to think they will struggle much more than investors who are focused on core investment strategies – which Wealthfront and Betterment embrace.

Warren Buffett, the most successful investor of all time, was asked by Tim Ferris what he would invest in. Buffett’s answer was simple: a single low-cost US Market index fund. If you’re not sure what a “low-cost US Market index fund” is that’s OK! It is one of the holdings that both Betterment and Wealthfront will invest in for you automatically, which is a good confirmation that using either is a good path to wealth.

Types of Investing and Advisors

Before getting too deep into the difference of Betterment/Wealthfront with alternatives, here’s a breakdown on the 3 categories of investing that I’ve run into:

Percentage-Based Financial Advisors

These advisors will usually charge a percentage of your total assets under management as a fee. This fee will usually be paid out a cash portion of your account. When funds have dividends, some of the dividends will go to cash, then be siphoned off to pay the percentage fee. Traditional financial advisors at most banks and investment firms use this model, but Betterment and Wealthfront also use it. The biggest difference is the amount of the fee. Here’s a quick fee breakdown:

| Betterment | Wealthfront | Vanguard Self Managed |

Standard Financial Advisor | |

|---|---|---|---|---|

| Fee First $10k |

0.25% | 0% | 0% | 1% |

| Fee $10k-$100k |

0.25% | 0.25% | 0% | 1% |

| Fee Above $100k |

0.25% 0.40% for premium |

0.25% | 0% | 1% |

| Average Expense Ratio Fee | 0.12% | 0.12% | 0.08% | 1% |

| Total Fees Over $100k |

0.37% 0.52% for premium |

0.37% | 0.08% | 2% |

| Estimated Fees 7% Growth over 30 years w/$100k invested |

-$77,628 -$106,869 for premium |

-$77,628 | -$19,200 | -$337,592 |

| % Of Growth Lost to Fees | -10.2% -14% for premium |

-10.2% | -2.5% | -44.3% |

Wealthfront is cheaper at each, or equal to Betterment for values under $100k. After that Wealthfront is cheaper. Regardless of your amount, traditional financial advisors usually charge more, and Vanguard (or a similar index fund approach) will be less. That 0.15% different may not seem like too much, but in long-time horizons with all other things equal, it can be the difference in how many years you’ll need to work before retiring. Whether Betterment makes up that difference through other services is going to be near impossible to tell.

I’ll dig deeper into the topic of fees in Part 5 – Fees and Tax-loss Harvesting. With Wealthfront, you’ll lose roughly 9% of your portfolio gains to fees over 30 years. With Betterment, you’re closer to 12% for their premium service. As a comparison point – if you self-manage your investments with Vanguard funds, you’ll lose closer to 2%. That’s a long time horizon. I wouldn’t let that fee difference over that time period be a major deterrent. It’s still next to nothing compared to using a financial advisor.

If you instead worked with a financial advisor that charged a 1% fee and they selected funds fund with a 1% fee, you could lose closer to 44% of your investment gains to fees over 30 year! This is the situation I was in when I started investing.

Although Wealthfront is cheaper, it’s not worlds cheaper. Both in the same general price range and comparatively priced.

Fee-based Financial Advisors

These are advisors that you pay a one-time fee and they give you advice or even execute on that advice for you. The difference here is that you only pay when you need advice, or need actions to be taken. If these fees aren’t tied to the value of the funds (ex: 1% fee anytime you buy/sell), then these can be a great option to have someone to learn from while you’re learning how to invest.

Self-Managed Investing

The non-advisor route. If you have a 401k, it’s probably self-managed. You might have a 401k representative at your company or the 401k company, but they’re not picking out your funds for you. You can self-manage your own investments at Vanguard, Fidelity or any other place that allows you to buy investments.

This is what I personally do now. If I had started this way, I would’ve still made mistakes – either have picked funds I later wanted to sell, sold too often or paid too many fees.

Picking an Investing Strategy

So, which of these three should you go with? This is really getting to the entire heart of this entire series. I’m going to bury the lead and give a recommendation here in the first post. If you’re curious how I got to these recommendations, I’d encourage you to follow along with the series as it’s released.

I don’t think it’s possible to give a “one shoe fits all” recommendation on which strategy to use. I think there’s a possibility of each working out (with the exception of high-cost advisors, which I personally advise against). With that caveat given, here’s the advice I’d give depending on your actual goals:

If you want to make the most money

Vanguard has the lowest fees. That’s a known quantity that you can plan around. Most of what Wealthfront and Betterment both invest in are Vanguard-like funds.

Wealthfront and Betterment suggest that features like tax-loss harvesting could end up paying off long-term and making up for this difference. I believe that at face value — that there is a specific market movement that could lead to making more money using robo-advisors. The historical trajectory of the market is up, and when the market is up, there is little ability to use tax-loss harvesting.

For my investments, I purchased a bunch of them years ago. Nowadays, everything is so far in the green that if these were the funds held within Wealthfront or Betterment tax-loss harvesting would be an impossibility. I suspect that even with a year of solid growth, Betterment/Wealthfront accounts may be in a position where tax-loss harvesting may become impossible.

Because of that, the “most money” part comes down to a combination of fees, asset allocation and buying & holding. The last one is overlooked, but very important. Every time you sell funds, you’ll need to pay taxes on the gains. That’s money that’s not earning compound interest over time. Investing in things that you’re confident holding for decades allows for maximizing returns. If you’re confident in your investments – either in Vanguard, Betterment or Weathfront – and can just leave them alone, that’s a great place to be.

Note: Is there anyone who’s been using Betterment or Wealthfront for a few years who can log into their account and see how often their account has tax-loss harvested? My assumption is that it’ll only be possible in a downturn or market correction, but I’d love further clarification from someone who’s used their services for a while through the recent market increases.

If you want the easiest to start TODAY

Having set up accounts in all 3 of these, the one I’ve been the most impressed with was Wealthfront. Betterment does the best job of marketing and the logged-out experience before joining, but once you do make the choice to join, the introduction and workflow for making your first investment was worlds better with Wealthfront.

I was able to immediately add my Wealthfront account to Personal Capital* to see it. With Betterment, I saw the dreaded “there was an issue connecting to your account” message in Personal Capital.

On the user experience side, Wealthfront was just more fun. From simple things like animations and celebrations in the user experience when you connect your account, to more satisfying interactivity. This focus on making the user experience attractive is important. If you enjoy using their site, and want to come back for those celebrations, you’re much more likely to enjoy investing and invest more.

Vanguard, on the other hand, isn’t going to win any design awards. It’s utilitarian and basic. Any motivation you have to invest, you’ll need to bring with you, rather than be inspired while there.

For both Betterment and Wealthfront, after connecting my account and making a deposit, they immediately choose funds for me to invest in. I didn’t need to pick any funds out. They start you off with a risk assessment quiz, and that determines your risk tolerance, which then drives what you invest in. This was a bit of a surprise to just deposit money and be automatically invested, but that’s exactly the kind of decision that these advisors are making for you.

With Vanguard, you’ll need to pick out yout funds immediately. Picking your first funds to invest in can be hard! If you’ve never invested before, having that recommendation on what to choose from an expert (in this case Betterment/Wealthfront) can feel like a safe bet.

When I first invested with Vanguard, I got to the screen where I choose my investments and had to go off for DAYS to research it. The hard part is that if you’ve never chosen funds before, there’s a lot of knowledge that needs to be understood to make that determination. If you wanted to go the Vanguard route, I’d encourage you to look into a Simple Three-Fund Vanguard Portfolio, which uses the 3 largest funds at Vanguard in their areas. The earnings of this 3-fund portfolio will be similar to anything Betterment or Wealthfront is likely to create.

If you have the time to get real-world investing experience

Learning how to invest is a life skill. Like most life skills though, you can pay someone else to do it for you. I can’t imagine maintaining my own car, but I have friends who do it and love it. I’m one of those people – but for investing. If you invest with Vanguard, you’re learning this life skill.

Using Betterment or Wealthfront is choosing to work with a mechanic who’s going to tackle your problems and make sure you don’t break down on the side of the road. Between these two, Wealthfront is the mechanic who keeps things simple and explains them. Betterment is the one that lets you know your car is ready.

Wealthfront does a better job of keeping things simple and helping someone learn how to do it themselves. These services can act like a teacher, helping you understand how to invest. Of these two services, I think Wealthfront is the better teacher. Here’s what I mean by that. When Wealthfront invests your portfolio, it’ll look something like this:

My Wealthfront Portfolio

Wealthfront has chosen 6 funds for my portfolio. This a very well diversified portfolio! In my own allocation, I’d lean towards more US Stocks and less international than their choice, but it’s not a far-off recommendation. With only 6 funds, it’s easier to understand what Wealthfront is doing. Each of these funds is in a different market sector – that is they’re invested in areas of the least correlation with each other. This helps diversify your portfolio. If you can wrap your head around what Wealthfront is doing, you can develop a great understanding of diversification!

My Betterment Portfolio

Betterment also does this, but a little harder to understand what’s going on.

There’s a lot going on here. Rather than 3 funds (Vanguard) or 6 funds (Wealthfront), Betterment invested me in 11 funds. If you’re just getting started investing, how do you know which of these is better? 3 funds, 6 funds for 11 funds? The short answer is that they’re all about the same. The number of funds you’re in isn’t what matters, it’s the allocation – how those funds are spread out between US, International, Bonds and anything else.

In The Simple Path to Wealth, JL Collins even recommends a 2-fund portfolio with only US Stocks and bonds.

With Betterment, they invest in a lot more funds. So the question is why?

My assumption is that it relates back to tax-loss harvesting. But first off, what is tax-loss harvesting?

Tax-Loss Harvesting Primer

Let’s say you invest in a fund and it goes up $1,000. You sell that fund a year later. At that point, you’ll pay taxes on that $1,000 gain at your long-term capital gains rate, which will likely be 15%. So on that $1,000 in gains, you’ll pay $150 in taxes.

What if we switch it up and go more aggressive? You invest in 2 much more volatile funds. One goes up $1,400 and one loses $400. If you were to sell both of these funds, your net capital gains would be $1,400 – $400 = $1,000. Just like the first scenario, you would pay 15% tax on this amount, or $150.

Betterment and Wealthfront take this concept a little further. When your funds have lost money, and some set of criteria that only they know about have been met, they will sell your funds for a loss. This gives you that negative credit that can offset other gains. They do something interesting though – they immediately re-buy a similar fund. For example, they might sell a Vanguard International Market Fund, then buy a Fidelity International Market fund.

If this sounds too good to be true, you’re right. There is a rule against it. This is known as a wash sale.

The rule defines a wash sale as one that occurs when an individual sells or trades a security at a loss, and within 30 days before or after this sale, buys a “substantially identical” stock or security, or acquires a contract or option to do so.

Both Wealthfront and Betterment claim that their strategy of buying a similar fund works because it’s tracking a different index behind the scenes. One thing that’s actually nice about both Wealthfront and Betterment is that you can add your 401k or other investment accounts to their system to let them know what else you are invested in. This helps prevent wash sales as well, as it gives them more insight into other things you’re invested in from other accounts.

Comparison of Returns After One Year

Written February 28, 2019

It’s been more than a year since I setup this experiment and left it to run. Time to check in and see how things are going!

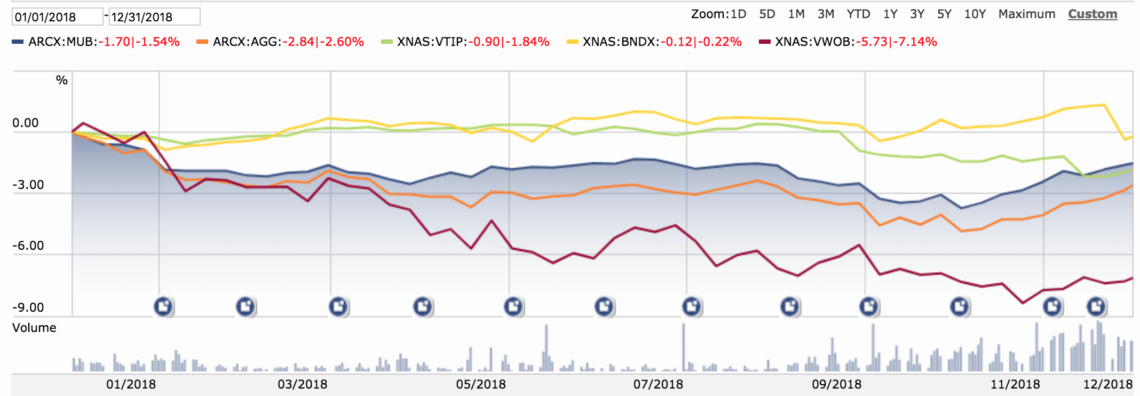

Buy first a disclaimer: A one-year comparison of any investments isn’t going to tell “which is best”. They will only tell which faired best in the specific market conditions of the previous year. For 2018, returns looked like this:

- +2.0% Cash

- 0.0% High Grade Bonds

- -2.3% High Yield Bonds

- -4.0% Real Estate Investment Trusts

- -4.4% Large Cap Equities

- -11.0% Small Cap Equities

- -13.4% International Stock

- -14.3% Emerging Markets

Whew, not a great year right? This included 11 months of (mostly) stock growth, followed by the worst December in my lifetime. These offer a great benchmark though to see how Wealthfront and Betterment compare.

Vanguard Returns in 2018

A few other points of comparison here from Vanguard:

- 0.0% for $VBTLX – Vanguard Total Bond Market Index Fund Admiral Shares

- -5.2% for $VTSAX – Vanguard Total Stock Market Index Fund Admiral Shares

- -14.5% for $VTIAX – Vanguard Total International Stock Index Fund Admiral Shares

The bond fund matches up with the benchmark perfectly. $VTSAX is a mix of Large Cap Equities and Small Cap (leaning towards large cap), so it’s -5.2% performance is right on target.

But what’s up with $VTIAX? It did WORSE than both the benchmarks – what gives? Turns out it’s actually right on target as well according to Morningstars index. $VTSAX also beat it’s index, although it underperformed the S&P 500 by 0.1% (which is close enough to call as equal).

So, in other words – Vanguards performance was predictable with the markets. It matched what we see in the global economy. This is important! Imagine you’re investing, and the economy is doing amazing but your funds aren’t increasing in value. That’s a real problem.

From my experience investing and researching in Vanguard, they match the benchmarks extremely well year over year – which makes sense considering they’re coming from the same place.

Wealthfront Performance for 2018

Wealthfront looks quite a bit different. For once, it’s not a single fund, but a collection of 7 different investments. Our total portfolio return will be driven by how much is invested in each of those 7 investments.

Here’s a look at the performance over time for the year:

The $10,000 I invested in Wealthfront hit my account on January 3, 2018, and as of December 31, 2018, they were worth $8,950.01 for a loss of -10.5% for 2018.

Just a note from this image for later: those bubbles at the bottom of the graph are tax-loss harvesting events.

Comparing this to the benchmarks, it seems somewhat odd that it’s this high at first glance! For one, the performance line is flat in a year where US stocks had 10%+ gain (up until December). A quick look at the asset allocation makes it clear though.

The lowest performing asset classes were emerging markets and international markets. Wealthfront happened to have over 40% of the total portfolio invested in these two classes.

That’s not too unusual though. Recent reports mention that 55% of the total equity activity in the world is based outside the US, with 45% in the US. Wealthfronts distribution of US vs International matches up with this very well. Unfortunately, it just didn’t have the best year.

Breaking this portfolio down to the basics, it looks something like this:

I do think the 18.2% in emerging markets is overly aggressive myself. My personal target for emerging markets is closer to 5% max. Or even better, just invest in $VTIAX (Vanguard International Fund) which is invested 22% in international markets already.

tl;dr on my Wealthfront investment: it went down 10.5% in 2018, mostly due to a large international position.

Betterment Performance for 2018

Wealthfront was down 10.5% – should we expect the same from Betterment? Let’s switch things up and look at the asset allocation for Betterment again first.

Just like when I initially created the account, Betterment invests in quite a few more funds. While Wealthfront invests in 7 funds, Betterment has 12 total. The important thing though isn’t the number of funds, but the breakdown to US/International/Bonds. We can compare Wealthfront, Betterment and my Simple Vanguard Portfolio to see how they differ.

Looking at this, it makes it clear where each account type focuses most. I tend to lean towards US Stocks at the largest fund in my Vanguard accounts. Betterment puts a huge weighting towards bonds, while Wealthfront puts much more towards international funds than the others.

Since Betterment invests so much more heavily in bonds in a year that Bonds had the best return, I assumed Betterment would far outperform all the other allocations. Turns out I was wrong. Here’s a look at my Betterment Accounts performance for 2018.

The $10,000 I invested in Betterment went down –7.5% in one year. That’s still quite a lot better than Wealthfront’s -10.5%, but it’s still not great.

Betterment & Wealthfront vs the Benchmark

Since we know how much of Betterment and Wealthfronts were invested in US, Intl and Bonds, we can see how those performances would compare with a similar benchmark – in this case, the comparable 3 funds from Vanguard.

Here’s how this will work. Let’s compare 3 asset allocations assuming they were invested completely in $VTSAX, $VTIAX and $VBTLX (Vanguard US Market, International Market, and Bond Market).

In our Simple Portfolio, we invest like this:

- 20% Bonds (I put this as age/2 in bonds while working)

- 53.3% US funds (2/3s of what’s less after bonds)

- 26.7% International (2/3s of what’s less after bonds)

Looking at that allocation, we could calculate that a $10,000 investment into those classes would have dropped to $9,335.69 after one year. In other words – even if we were investing for ourselves we would have seen a big drop of -6.7% in our accounts. That’s not as bad Wealthfront’s -10.5% or Betterments -7.5%, but it’s close.

If we ran these same number on the asset allocation from Wealthfront and Betterment, we see they do slightly better than the accounts actually did:

- Wealthfront: -8.6%

- Betterment: -5.9%

For comparison, here’s the full table on this.

Betterment and Wealthfront both performed worse than I expected them to, and in this comparison to the benchmarks they underperformed by about 2% each. Why?

It’s not fees. Both Wealthfront and Betterment do charge a management fee. Betterment charged fees totaling $24.29 – which is in line with their 0.25% management fee on my $10,000 invested. Wealthfront charged $0.09 in fees. Looking at their fees page, they do charge the same amount as Betterment, but I had my first management fees waived on my first $10,000 due to a promotion when I signed up. Either way though – that amount isn’t 2%.

The real answer is International & Emerging Markets. In my Simple Vanguard Portfolio, 26.7% was invested in international, which was the lowest of the bunch. Wealthfront had the most invested in international funds and so it performed the worst. Wealthfront also had much more invested in emerging markets (18.2% vs my portfolio which had ~6%) as well as 5% invested in Natural Resources in $VDE, Vanguards Energy Fund which went down an astounding 22% in 2018.

Betterment too was 2% off the comparable Vanguard index for the same general asset allocation. In this case, the reason for the difference isn’t as clear. There is a 4.4% holding in a small-cap fund which pulled performance down a little. The 40% bond allocation isn’t purely in high grade bonds either, but in a mix (which is usually good, but didn’t have the best year). Here’s a look at just how different the bond funds that Betterment uses are.

While $VBTLX (Vanguards Bond fund) was at 0%, these bonds ranged from -0.22% to -7.3% (!). The lowest performing one was $VWOB, Vanguards Emerging Markets Government Bond ETF. With about 6% in this one fund, that starts to explain the difference in 2% amongst all these bond funds that all lost a little more than the Vanguard equivalent.

Tax Loss Harvesting Comparison for 2018

Betterment and Wealthfront both tax-loss harvested hundreds of dollars. Betterment harvested $918.21 while Wealthfront grabbed $1,151.23.

It’s important to understand what this is offsetting. Having these handy allows me to write off a comparable gain and not pay taxes on them.

For Betterment, they sold $201.90 of gains, meaning that after the tax-loss harvesting kicked in, I had a -$751.81 credit to offset other investments (this year or later). If I had sold other funds this year (and I did) I can offset $750 in gains and pay no taxes on them – not too bad!

Wealthfront did even better there, with $1,151.23 in TLA harvested. Of that amount, none of it was offset in gains – meaning I have $1,151.23 in credit towards other investments this year.

It’s hard to say how good or bad these performances are overall from a TLA standpoint. Tax loss harvesting is a confusing topic that’s highly dependent on what you’re doing that year and in future years.

For me, in 2018, I had a lot of capital gains, so these credits went to offset a small amount of those. In future years, I plan to pay nearly no capital gains taxes – which would make tax-loss harvesting not needed. Determining whether or not you’ll benefit from tax loss harvesting requires knowing how you’ll pay taxes now and later on all money you have.

My Recommendation

If you’re just getting started today and you want to invest but don’t want to spend weeks, or months learning how to invest, then my recommendation is to use Wealthfront. Even though it had the lowest performance in 2018, it is the most aggressive robo-advisor of the pair.

If you have the time to learn, even with a basic three fund portfolio you could have had greater returns than both robo-advisors in 2018. That 2% difference in returns isn’t much in one year, but if it’s 2% each year then that’s huge. I look forward to updating this post in a year to see how 2019 shakes out!

Robo-advisors are easier to use, and have core concepts on investing that match closely to my own – and even has reasonable fees. Each of these would have been great by itself, but it so happens that Wealthfront wins in all three categories over Betterment. Here’s a breakdown of which advisor I prefer for each category.

| Category | Betterment | Wealthfront |

|---|---|---|

| Management Fees | 0.25% to 0.40% + Expense Ratio | 0.25% + Expense Ratio |

| Ease of Use | Good, but some issues (UI interactions, connecting account to Personal Capital didn't work at first) | Everything worked! |

| Account Minimum |

$0 $100k min for Premium |

$500 $100k min for direct tax loss harvesting, $500k min for Advanced Indexing |

| Average Expense Ratio | 0.12% | 0.12% |

|

Portfolio Allocation By answering questions the same |

Leans conservative | Leans aggressive |

| Account Types | Individual, joint, Roth IRA, traditional IRA, SEP IRA, Trusts. | Individual, joint, Roth IRA, traditional IRA, SEP IRA, Trusts, 529 College Savings |

| Mobile App | TBD | TBD |

| Ease of Moving to Another Brokerage | TBD | TBD |

| My Favorite |

Whether you choose to invest with Wealthfront, Betterment or do it on your own, I would strongly encourage you to invest. Investing is possibly the most important thing you can do if you want to be financially independent.

How do you invest? Do you have any questions about robo-advisors? Do you prefer Betterment or Wealthfront?