The 2019 tax brackets were released mid-last year to a ton of fanfare. This is the second year with the new brackets, passed by the Tax Jobs and Cuts Act of 2017 and signed into law by Trump on December 22, 2017. These “cuts” have caused quite the controversy due to their favorable treatment for the rich (ie, if you make a lot a money then you just got a tax cut).

In this article, we’ll take a look at the tax brackets for 2019, how they’ve changed single 2018 and how much you’ll likely pay in the new year.

2018 Taxes Review

In 2018 there were some major changes to the tax bracket. New tiers were introduced, some exemptions were cut – and it made it very difficult to do an apples to apples comparison with the previous year.

As I’m writing this in December of 2018, the year isn’t even over! No one has filed their 2018 taxes yet, so you may not know how those changes impacted you yet. That’s OK.

One part of the 2018 tax bracket that I actually like (for the minimalist in me) is leaning more on the standard deduction and less on an ever-growing list of exemptions. This has meant that many people that had multiple exemptions are now seeing themselves paying more in taxes.

The biggest exemptions which were changed were:

- Eliminate most itemized deductions including moving expenses (unless you’re in the military).

- Due to the higher standard deduction, the usefulness of the mortgage interest deduction is significantly reduced, since it only makes sense to use them if your total deductions are above the $12k/$24k standard deduction. If you do itemize, the deduction is limited to interest on the first $750,000 of the loan.

- You can no longer deduct paying alimony starting in 2019.

- There’s a $10,000 limit on state and local tax deductions. This includes property taxes, income, and sales tax. If you’re in a high-tax state (like New York or California) this might drive up your taxes.

- Elimination of personal exemptions. Previously, families got a $4,150 credit for each child.

- You can still receive a child tax exemption/deduction of up to $2,000 for each qualifying child under 17 you claim as a dependent. You get this deduction for all of your children.

- A full list of credit deductions can be found on the IRS Credits & Deductions website.

That’s a lot to figure out. I’m a person who likes financial stuff, but trying to come up with a clear answer on “will my taxes go up or down?” has so many variables that it’s unrealistic to hit your specific case.

There’s also a pretty major downside to this change. That $10,000 limit for state and local tax deductions is HUGE if you’re paying a lot of state taxes each year.

In 2018, compared with 2017, you may have seen your taxes rise. There are a few reasons for this:

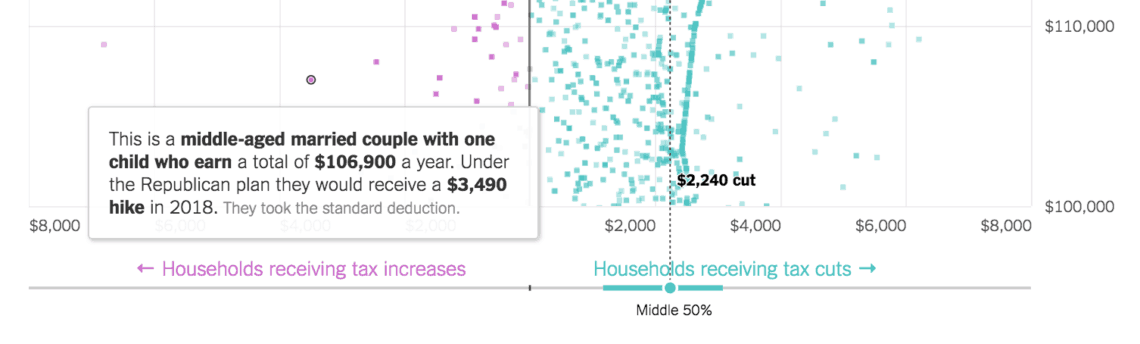

Instead of trying to calculate your specific situation, the best visualization I’ve seen on the topic is from The New York Times. They mapped out over 220,000 households and broke them down by their key traits: filing status, income, and the number of kids.

Check off a few traits and you’ll quickly see how much other people in similar filing situations are impacted by the tax changes.

For example: a married couple with one child under 17 making between $100k and $150k can quickly see that others in their shoes are getting somewhere around a $2,240 tax cut. But it’s also not cut and dry. There are outliers who would have as much as a $6,000 tax hike on $100k of income!

So who are the outliers who would be seeing an increase in their taxes? It’s hard to say from this chart, but the most obvious one are people paying a LOT of money in state taxes or property taxes. Take this one outlier here:

Why did they see a tax increase? They took the standard deduction this year, so they deducted $24,000. For them to have paid an additional $3,490 in taxes, they would have previously have been able to deduct closer to $40,000 ($24k + $3,490/22%). So for this “tax cut” they likely lost the ability to deduct that additional $16,000 in income, resulting in a higher tax bill.

It’s impossible to say what deduction they lost, but the best bet would be a state income tax deduction. For 2018, they were limited to a $10,000 deduction in state income and property tax. If their actual state taxes were closer to $26,000 – maybe property tax in an expensive area, or high state income taxes – then they would end up paying quite a lot more.

This brings up the biggest losers for this bill: people with houses in high-tax states. Even though I’m not affected, this change really bugs me. Mostly because it’s a tax that disproportionately affects on people who DIDN’T vote for Trump – since some of the states with the highest taxes are blue states.

I’d encourage you to check out the NY Times visualization and find your specific situation. Keeping in mind that if you have a ton of state/property taxes then you might be farther to the left on the chart.

Where We Are On the Chart

It’s going to be a weird tax year for us. There’s a lot of differences in our tax situation this time around, which makes it impossible to do a straight comparison between last year and this year. For example:

- After living in Florida our entire lives (where there is no state tax), we’ll now be paying taxes here in Utah.

- We sold our house in 2017, so we don’t have any property, so we won’t be paying tax on that.

- Utah has a flat 5% short-term and long-term capital gains tax (in addition to the federal rate).

- We’re selling a bunch of stock for long-term capital gains, probably around $300,000.

The $300,000 stock sold will incur $15,000 in Utah taxes right there. Eek. My hypothesis on this is that I’ll pay less federal taxes than I would have in 2017, but with the addition of some not-insignificant state taxes.

Wait, why’d you move to Utah if you were going to sell all this stock?

Honestly, we didn’t know! I was fortunate enough to work at a company that went public. Like the rest of the world, we didn’t know it was happening until it happened.

If I knew now what I know, would we still have moved from Florida? It’s hard to say. From a financial standpoint, living in a state with no income tax would be great right about now. 5% of $800k will be around $40k in total taxes – which is basically another year of spending we’re putting straight towards taxes.

It’s likely this will end up being one of the costliest decisions of my life to move here. I’m OK with that though. I can’t dwell on decisions I would’ve – especially with imperfect information.

I (actually we) can decide if it’s worth it to move out in 2019. If it made enough financial sense, we could pick up and leave tomorrow. To me, the answer is no – in fact, we just renewed our lease here to stay another year! We know this means we’ll be paying a bit more in taxes than we would in a state with no income tax, but we’re OK with that.

This is a good thing to think about though. If you have sizable stock in a company that is going public, maybe think about staying/moving to a state where you’ll pay less taxes. Florida and Washington are pretty nice places too!

2019 Federal Tax Brackets

Ok, so that’s enough of 2018. How are things changing in 2019? The good news is that the rates are the same (the percentages). The only thing that changed in 2019 was raising the incomes in each tier – which means everyone would pay the same or fewer taxes (all other things equal).

| Rate | Unmarried or Filing Solo | Married, Filing Jointly | Head of Households |

|---|---|---|---|

| 10% | $0 - $9,700 $9,526 |

$0 - $19,400 $19,050 |

$0 - $13,850 $13,601 |

| 12% | $9,700 - $39,475 $38,701 |

$19,400 - $78,950 $77,401 |

$13,850 - $52,850 $51,801 |

| 22% | $39,475 - $84,200 $82,501 |

$78,950 - $168,400 $165,001 |

$52,850 - $84,200 $82,501 |

| 24% | $84,200 - $160,725 $157,501 |

$168,400 - $321,450 $315,001 |

$84,200 - $160,700 157,501 |

| 32% | $160,725 - $204,100 $200,001 |

$321,450 - $408,200 $400,001 |

$160,700 - $204,100 $200,201 |

| 35% | $204,100 - $510,300 $500,001 |

$408,200 - $612,350 $600,001 |

$204,100 - $510,300 $500,001 |

| 37% | $510,300+ | $612,350 | $510,300 |

That’s a lot of green! Does that mean you’ll pay fewer taxes in 2019? If you make over $9,526 (solo), $19,501 (jointly) or $13,601 (head of household) then yes you will get a tax cut.

The size of that tax will be dependent on how much you make. The more you make, the bigger the tax cut you got in 2018.

That comes down to the bracket definition – that these are a progressive tax. What that means is that your taxes aren’t calculated as the rate next to your income alone, but instead the the sum of all previous tiers. Let’s look at an example and see what I mean.

These assume this is their income after all standard deductions. For simplicity this also excludes any local state taxes.

Example: $50,000 a year filing jointly

To calculate their taxes in 2018, we could use the following formula:

That makes for an effective tax rate of 11.23% in 2018. How about 2019?

That makes for an effective tax rate of 11.22% in 2019. A $7 tax cut. Wow. Don’t spend it all in one place!

Taxes by Income Level

It turns out, for 2019 taxes will be roughly the same as 2018. That might not mean much to you yet if you’re still figuring out your 2018 tax situation, but at least once that’s finalized you’ll know what to expect for 2019.

How similar will the rates be? Here’s a look at how much more you’ll get back in 2019 compared to 2018 for a couple filing jointly.

- $0 – $20,000: $0 savings

- $20,000 – $80,000: $7 savings

- $80,000 – $170,000: $161 savings

- $170,000 – $320,000: $230 savings

- $320,000 – $410,000: $745.80 savings

- $410,000 – $610,000: $991 savings

- $610,000 +: $1,238 savings

Note: For married filing jointly. All numbers rounded.

These changes help keep the take home amount you’ll receive not too far off after taking inflation into account.

Capital Gains Taxes

Like federal taxes, capital gains taxes haven’t changed much for 2019. The brackets have inched up slightly as well. Each tier went up about 2%, keeping pace with inflation rate of 1.9% for 2018.

Individual Capital Gains 2019 Tax Rate

| Rate | 2018 Rate | 2019 Rate |

|---|---|---|

| 0% | $0 - $38,600 | $0 - $39,375 |

| 15% | $38,600 - $425,800 | $39,375 - $434,550 |

| 20% | $425,800+ | $434,550+ |

Married, Filing Jointly Capital Gains 2019 Tax Rate

| Rate | 2018 Rate | 2019 Rate |

|---|---|---|

| 0% | $0 - $77,200 | $0 - $78,750 |

| 15% | $77,200 - $479,000 | $78,750 - $488,850 |

| 20% | $479,000+ | $488,850+ |

Just like federal taxes, capital gains taxes are progressive. If had $100,000 in capital gains and you were filing jointly with no other income for the year, then you’d pay $78,750 x 0% + $21,250 x 15% = $3,187.5.

Keep in mind though that’s $100,000 in gains, not the total amount sold. This relates back to my future strategy for how I plan to spend $80,000 a year and pay nearly $0 in taxes each year.

Your Taxes for 2019

If your financial situation is roughly the same in 2019 as it is in 2018, your tax footprint should stay about the same – or go down a few bucks.

If you’re like me, 2018 taxes are a big question. At least once you have an answer to that, you’ll be able to plan for 2019 accordingly.

JoeHx

December 17, 2018

It looks as if I’ll be in the same tack bracket for 2019 that I was (or am) in 2018, but I guess that’s what I get for being smack-dab in the middle of the bracket. Although with the tax brackets beneath me raising their income limits, I suppose that means I might be paying less taxes overall.

Bernz JP

December 17, 2018

Almost the same income for me and my wife as last year and as far as tax deductions and exemptions go, not much change there either. We’ll most likely be in the same bracket for the year 2018.

Mr. Frugal Hacker

December 17, 2018

Did your old company compensate you with stock options? Unless you’ve already exercised and held them for at least a year, they don’t normally qualify for long-term capital gains? If you’re just “flipping” them (i.e. exercising and selling in the same transaction), that’s almost always considered a short-term gain. For Utah, that distinction doesn’t matter since the rates are the same, but for federal rates, it does matter, and it makes a huge difference in the amount of taxes owed!

Another distinction is that if these aren’t pre-exercised options, then many states will tax based on where you lived when you earned/vested the stock options, rather than where you sell them. If you had already exercised them over a year ago, then you might want to consider moving 2 hours west (~125 miles) to West Wendover, Nevada to reduce your state taxes to 0, since Florida is so much further away. If you moved there for 6+ months, and sold all your stock there, you can even keep your lease in SLC since the amount of tax savings will likely outweigh your rent in SLC.

Would love to see a follow-up post on all these secondary considerations.

Adam

December 17, 2018

Whew, yeah that’s a lot of things to consider. For the shares I have, they were never options. They went from % ownership of a startup straight to shares in a private company to shares in a public company. From what we’ve heard, the cost basis will be $0 for these shares, with an issue date for when I received the shares in the private company. Based on what my tax person has said (and someone which knowledge of the deal), I _think_ that’ll mean long-term capital gains. Do you have any more thoughts/context on that I should be watching out for? Or does that make sense? This is all very new to me.

Moving to another place would be rough, since Mrs. Minafi works in SLC. If we are spreading this sale over 2018/2019/2020, then we could potentially deduct $10k/yr on each year’s federal taxes at least, which would give a little back. Still a costly sale compared to if we had stayed in Florida.

Mr. Frugal Hacker

December 18, 2018

Yeah definitely sounds complicated. Do you recall paying any short-term (or regular income) taxes as soon as you received the shares in the new private company? Or does the cost basis of $0 imply no taxes were immediately due for that tax year?

Since it’s likely it’s been more than a year since you received those shares, then it makes sense that selling what you have will qualify as LTCG. Can Mrs. Minafi work remotely for ~6 months from NV/WA/FL? Another extreme idea is for you to go live separately for 6 months in Nevada which is 2 hours away (and visit Mrs. Minafi on the weekends), but the Utah govt may not look too kindly upon such tax optimization strategies. And most people would not want to live separately from their partner for a mere $40k anyways.

Btw, the $10k/yr deduction on the federal return is only applicable if you sell $200k worth of stock every year (which you’ll likely do), but more importantly, you need to have at least another $14k of further itemized deductions (such as mortgage interest) to make it better than the $24k automatic standard deduction. But because you live in an apartment paying rent, you likely have no mortgage interest to deduct.

Furthermore, a decent chunk of that $10k deduction will already go to the state taxes Mrs. Minafi will be paying from her salary, so the amount of room available to you for deductions is further limited. All in all, it looks like the value of the $10k/yr federal deduction is pretty marginal unfortunately. The main reason to spread the sale over multiple years would be to capture any appreciation in the stock price (which can be a lot more than the 5% state tax rate). It also gives your family a chance to potentially move to a no-tax state in the future if circumstances change (which can be pretty hard to predict right now).

Overall, a wonderful first world problem to have 🙂

Adam

December 19, 2018

Hmm, yeah you’re right on the $10k state deduction – it seems unlikely I’ll hit the $24k point where it’ll even matter. While we don’t know for sure where we’ll end up in 2020, I think the NV/WA/FL options are out of the cards for this year. With selling 1/3 in 2018 that ship has sailed already. Perhaps 2019 as well. 2020 though – that could work to potentially be somewhere else (time will tell!).

When the company was sold, it was for cash + equity. I paid some taxes immediately on the cash portion, but none (I don’t believe) at any time on the equity side. When that was converted to shares at the IPO I didn’t pay taxes then either – but then again that’s 2018 so we’ll see.