Whew, it’s hard to believe it’s been an entire year (to the day) since I left my job at 36 years old. December 14, 2018, was my last day before retiring early and beginning to figure out what a day looks like without 8 hours at a desk.

The transition from coding, meetings (most of which I was running), constant Slack & email and relying on a todo list to now having near-complete flexibility was a massive shift.

I wrote about some of my initial reactions after three months of early retirement and again after six months. During the last six months, I’ve attempted to slow down more, spend more time enjoying life, play more video games, spend more time with friends.

A big part of that is trying to deprogram myself from the idea that I need to constantly be working on things that are productive. After a lifetime of that belief, it’ll take some time to change my mindset! I still want to do productive things, take up new and fun projects, and challenge myself – but it’s OK not to work on them like they’re due at the end of the quarter (*shiver, that word*).

With that in mind, here’s a look back at a few things from this year that have worked well, not-so-well, and what I’d do differently (or will try to do differently going forward).

What’s Worked Well?

Know, or define, what you’re retiring to. One of the most common gripes against early retirement is the question “what will you do with all your time?”. I haven’t counted the number of times I’ve been asked this question, but it’s absolutely been over 100 in just the first year. My answer is usually the same:

Since I left my job I’ve been doing the same things I did at night and on weekends – only slower.

My answer to the question “What do you do all day?”

I had so many things I was working on at night and on weekends that it’s been easy to let those fill all available time. It’s meant not needing to make tradeoffs like “should I go to the gym after work or make dinner”. Now I have time for both!

Having a bunch of hobbies, goals, and interests is helpful. For me, that’s involved programming projects, working on Minafi, catching up on TV shows and movies, hiking, skiing, CrossFit, learning how to create and edit videos, learning Japanese, learning more recipes – and quite a few other things.

I didn’t start doing these when I left my job either – I was doing them all before that. Now I just get to plan my day around them!

Limit commitments. After leaving I didn’t have anything specifically lined up to take up my time. If I had committed to too much right out of the gate that would have put off unwinding after a career. For example, I’m glad I didn’t commit to writing a book, attempting to grow this blog into something that makes money (it loses money every month), or seek out other activities that would eat up all my time.

Focus on one thing. The times this year when I was the happiest and most productive, was when I picked a single thing and focused on it. At the beginning of the year, I decided I wanted to focus on my physical and mental health and used that to influence what projects I worked on. Picking a focus has the added bonus of being able to look back at the year and see where my time went:

- December – February: Using my Ikonpass to the fullest and skiing a few times a week

- February – April: Revamping Minafi from WordPress to Rails

- April – June: Hiking mountains!

- May – July: Training and running a half-marathon

- August – September: Learning and experimenting with Data Visualization.

- October – December: Working on and launching the Minafi Investor Bootcamp!

One activity I love is setting a focus for each month right before it starts. That focus can be simple: running, drawing, hiking, cooking – something you want to keep in mind throughout the month.

Having that focus helps make those small decisions that add up over time. “Do I work on training for a marathon or write a blog post” can be easily answered if your primary focus is “Train for a Marathon”. You can still write that blog post but do your training first.

Make time for friends! We’ve been fortunate to find a number of friends here in Salt Lake City since we moved to Utah two years ago. Between a constantly active group WhatsApp message, watch parties for Game of Thrones/Watchman and a bunch of board games, we’ve seen friends more this year than any other.

In the past, I’ve skipped out on a lot of outings because I was too tired, or drained from the week. That still occasionally happens, but it happens a LOT less than it used to.

Have a creative outlet, an educational outlet, and a physical outlet. In other words, don’t pit your interests against each other. If you want to learn how to program, learn a new language and learn a new instrument you’re gonna to have a bad time. The same problem happens when you buy 10 video games and can only play them one by one. Don’t pit your interests against each other.

Be OK iterating your schedule. Once you know what to focus on, it all comes down to execution! If what you’re doing isn’t making progress then be OK switching things up. For example, I was having trouble working out at the end of the day so I moved that up from 4 PM to 12 PM – which has been great so far. Knowing that I always work out just before eating lunch creates a cornerstone to plan some of my day around.

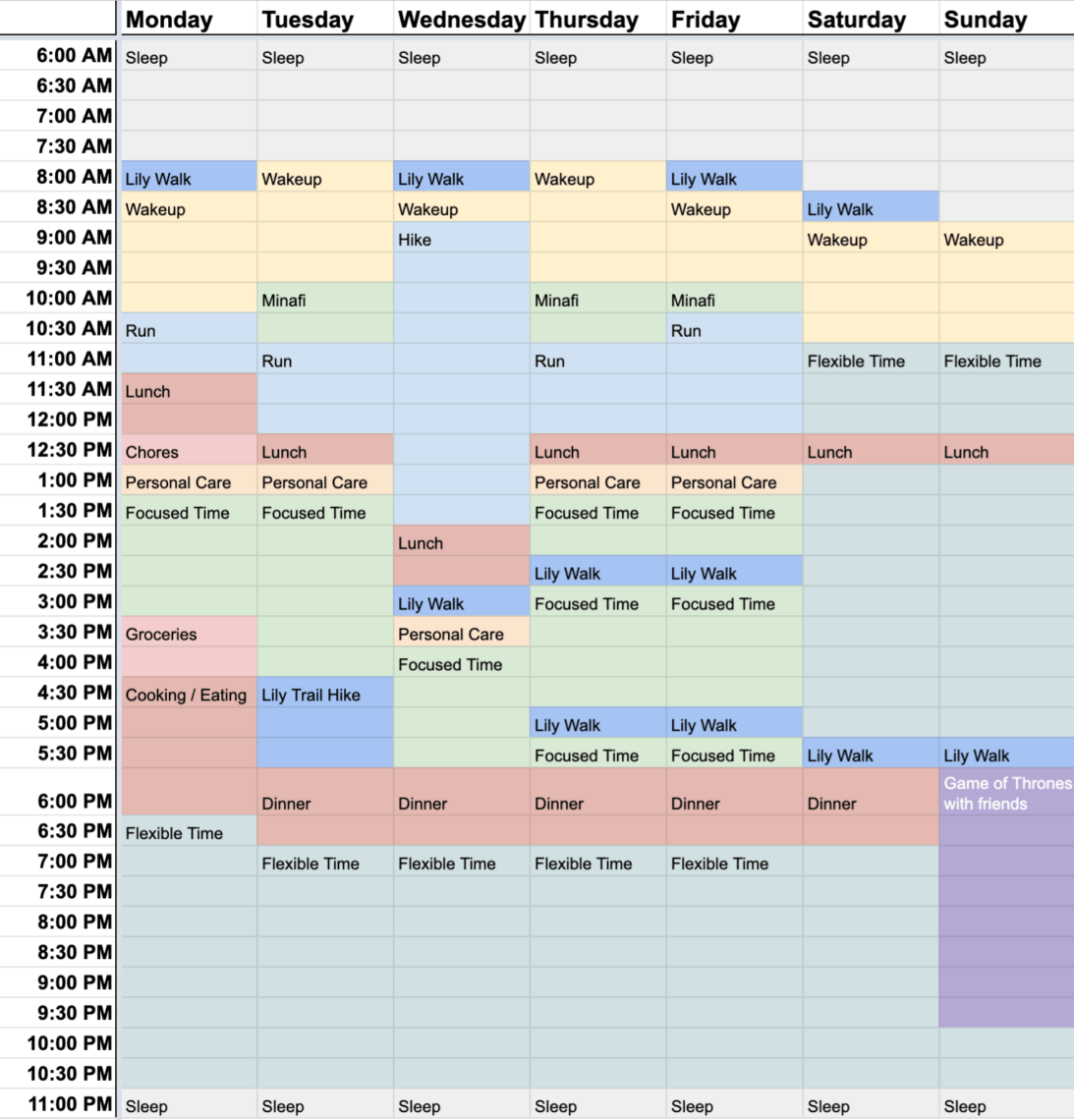

Before I left my job, I tried creating a “perfect week“. After a few months of not working, I compared my actual schedule to that idealized week. The results were clear: I slept a lot more, I had less focused time and a lot more “flexible time” to do whatever felt right.

The same iteration helped when I tried a month-long digital declutter without social media. I love having the option to just try out new days and new schedules and see how it feels. Whether it works or not you’ll know if it makes you happier, healthier or more productive!

Create strict rules when you need them. One of the most important things you can do is keep promises to yourself. If you develop a habit of keeping your agreements – no matter what – builds grit, character, and confidence. The times in my life with the most personal growth have been when I made a lot of agreements to myself and then kept them. I set out a few personal rules when I left my job that has been extremely helpful:

- Don’t drink/smoke at home during the day – only at night.

- Exercise at least 3x a week, ideally 5x.

- Have a date night out with my wife every week.

I’ve had other goals for sure, but these ones are non-negotiable. By practicing these daily they become clear habits where I don’t even need to think about doing these actions – they’re just part of my days. As I grow older I’ll likely add to this list, but only when I can do something (or need to do something) every single time, no matter what.

As part of this, I workout MWF without question – sometimes TR as well. I’m playing with the idea that I’ll set MWF as “productive” days too. The idea is that on these days I’d force myself into action – writing, programming, housework – whatever needs to be done. Then other days are flexible to do whatever I’m feeling.

What Hasn’t Worked Out?

That unproductive feeling. This isn’t new to FIRE. Whenever I have a project I want to work on – whether that’s a coding project, a creative one, a fitness one, or something else – I feel unproductive when I’m not making progress on it. Having more available time in the day only amplifies this feeling for me, as I have far fewer reasons for not progressing.

Doing too much. Even though I didn’t commit myself to too many things, I still quickly overloaded myself with projects, hobbies, fitness activities, books, things I wanted to learn and more. While all of these were fun things I loved doing, when it came to making a notable change it didn’t happen until I cleared my plate and focused on one thing.

Volunteer work hasn’t magically appeared. I have a confession: I haven’t done much volunteer work in my life. I wasn’t raised doing it, and I’ve struggled to find ways to help that I enjoy and feel like I’m honestly helping out. I didn’t go out of my way to find somewhere to volunteer, so it’s no surprise that I didn’t find something. This is something I want to figure out in 2020. Do you have any recommendations here? Either a way of finding a place to volunteer, or things you’ve done and enjoyed?

Flow has become more difficult. Do you ever have those days when you’re deep in the work on something and time flies by? That happens most when you’re working on exactly one thing and you’re able to put 100% of your attention into it.

Since having more flexible time, I’ve struggled to force myself to work on one thing at a time. I’ll program while watching TV (I’m currently rewatching Lost), I’ll cook new recipes while listening to audiobooks, or I’ll write a blog post while listening to impeachment hearings. In all of these cases, I’m getting things done, but I’m not getting that euphoric feeling of flow that comes with rapid progress.

What Would I Change?

Use Your Time to Recreate Your Values

One of the best uses of my time this year has been learning how to cook some of my favorite recipes. Learning how to cook one of the best returns on investments. The amount of money saved by eating home-made meals using ingredients from Costco is just insane. I see why there are so many frugal blogs that embrace this idea.

What’s valuable to you that you could recreate? It could be something fun like cocktails or homebrew beer. Something functional like furniture or dishware. Something fun like art or photography. Evaluate your spending and find out if there’s something you’re spending money on that you could replace by making it yourself.

Not every attempt at this is going to be a winner. I made Char Siu Bao this year (BBQ pork buns) and it was entirely too much work to be worth it. I’ll stick with the $1 frozen ones and save myself the time.

A few years ago I tried my hand at gardening for a season to grow some of my favorite veggies. We had tomatoes, carrots, jalapenos, cayenne peppers, watermelon, cilantro and more. Talk about a lot of work! I was out there every morning watering the plants, picking off bugs and making sure they were healthy. In the end, the total haul from our 48 sqft of garden could have been picked up at a farmers market for under $50. I wouldn’t do it again, but I left with an all-new appreciation for farming.

Set More Ambitious Goals

The times I’ve been happiest this year were when I set big goals and worked towards them over weeks or months. Redesigning Minafi, running a half marathon, launching a series of courses – all took months of work. I loved seeing these progress!

There were other times when I perhaps should have set more ambitious goals. When I was learning to ski, some of the best advice was to go AS MANY TIMES AS POSSIBLE. I only went weekly and I didn’t make as much progress as I could have. Setting an ambitious goal would’ve helped progress even more.

This goes back to having a solid list of what you want to know, have, do or be. With a clear list, it becomes obvious why you’re putting in the work to get there.

Take a look at your goals and check if they’re ambitious enough. If you accomplish them would you continue working on them, or would that be enough?

What About Money?

Oh right, this is a financial blog. To be honest I haven’t thought much about money this year. I’ve continued to track our spending in my custom spreadsheet and do quarterly write-ups here on Minafi, but beyond that it hasn’t been on my mind much.

My investment approach continues to focus on long-term buy and hold investing, which has meant I haven’t needed to do much of anything. During the year I did sell about $500,000 in company stock (more about that in my investment reports) which resulted in some of that in cash but most of it reinvested in the stock market.

Our spending for 2019 has stayed roughly the same as 2018 – around $7,000 a month for the two of us. That always seems like I lot when I say it. It’s more than many bloggers state. For us that looks something like this:

- $2,500 for Home: Apartment rent, renters insurance, utilities, home improvements, household supplies.

- $1,000 for Food: Groceries, dining out, coffee shops, lunches.

- $1,000 for Travel: Flights, hotels, food & drinks, experiences.

- $750 for Adam’s Expenses: Clothes, health, fitness, personal care, electronics, software – anything specific to Adam.

- $1,000 for Mrs. Minafi’s Expenses: Same as Adam’s expenses. Mrs. Minafi’s expenses are slightly higher because personal care for women tends to cost more (eg: haircuts, makeup).

- $500 for Entertainment: Including movies, TV, music, alcohol, and bars.

- $250 for Transportation: We downsized to one car in 2018 which helped! Insurance, parking, fuel, maintenance, and the occasional Lyft.

Side note: this doesn’t include Minafi’s expenses. I exclude those from our budget and think about it more like an investment that may pay off someday.

Is there room to cut? Yes! Obviously. Looking back 10 years ago we were spending about $2,000/yr on travel – now we’re dropping that on a single trip. What we are doing is spending in accordance with our values. We’re spending more on things that when we look back at our budget we say “Man, that was so worth it!”.

In doing that we eliminated other expenses that we didn’t enjoy: spending time and money to keep our house in shape (which is why we love renting), paying for landscaping, having two cars sitting in a garage, reducing the need for new clothes. Those cuts to our budget are just as joyful as the money we spent.

This has been an amazing first year. Having the time to explore hobbies and interests has been just as fulfilling as I imagined it. It hasn’t been all roses though. There are days, or even weeks, when I just want to stay in bed rather than go for a run. Times I want to binge-watch TV rather than program something envisioned. There are times when I feel incredibly unproductive and other times I’ve celebrated success.

It’s an incredible privilege to be able to retire early and set your own course in life. Fewer than 1% of people retire before age 50, with most people working into their 60s.

Have you retired? How was your first year? What went well and what didn’t?

One Frugal Girl

December 15, 2019

I love everything about this post. This is my dream for life once my children get a little bit bigger. It’s hard to find ‘focus’ time with them around right now, but I’m actively working on it. Cooking has become one of my favorite passions. We eat healthier and spend less money each and every time we cook at home. We also get remarkably better at cooking as the months progress into years. What recipes have you been making? Maybe you need a cooking with Minafi course in addition to your investing platform 😉 I’m glad this first year of FIRE is treating you so well.

Adam

December 16, 2019

I can only imagine how tough it is to find focus time in a hectic household. Even with a wife and a dog I struggle some days. ?

Food-wise we like a lot of Indian, Southeast Asian, Japanese and Ethiopian dishes. So far nothing has been too difficult to make – outside of things that require dexterity to create individual pieces (anything dim sum). I think good paying for someone much more experienced to make those haha. What kind of things are you making?

One Frugal Girl

December 16, 2019

We tend to cook Asian and Indian dishes. I am so thankful that we can find so many amazing spices at nearby stores. When I was growing up the spice aisle was so limited!

Adam

December 17, 2019

Ohh nice! Yeah having some local stores helps. One of our favorite discoveries was an Ethiopian restaurant that also sells niter kibbeh, which is basically ghee flavored with a ton of Ethiopian spices. It’s like finding a secret ingredient that makes the recipe easy.

Danny P

December 15, 2019

Looking for volunteering ideas? Why not focus on social justice issues, including helping out organizations trying to get rid of voter suppression and gerrymandering.

Adam

December 16, 2019

That idea is right up my alley actually. Thanks!

ShaDubya

January 23, 2020

If Activism counts as volunteering, Jen Hoffman at Americans of Conscience (https://americansofconscience.com/) has a no-drama weekly checklist that I have found a sanity saver. The last section is Acts of Gratitude. When I can’t muster energy to make a call, I can at least send postcards thanking others who are fighting the good fight.

Adam

January 24, 2020

I hadn’t heard of this one, but I like their simple pillars (democracy, voting access, equality, respect for aspiring Americans). Signed up to learn more!

Kamran @ Looks Good to Us

December 16, 2019

I loved this and I only just heard about your site via PoF’s Sunday Best ?

For volunteering, you are pretty similar to where I would be. A couple things come to mind:

Near me we have an org called CodeNinja and it’s a coding school for kids. They are always looking for volunteer or part time teachers. I’ve been interested in looking at that since it intersects with my love for programming and teaching.

I have volunteered for Habitat for Humanity before and that was fun. You learn real skills and get to help someone have housing. Win-win!

Since you enjoy programming, maybe find an open source project to contribute to where you can learn more skills or can provide value. Projects like HospitalRun or Humanitarian Toolbox could be fun and rewarding options! Not sure if there are events in Utah like here in Minneapolis but we have Non-Profit Hackathons sometimes where you volunteer for a day to help a non profit build something with other like-minded developers.

You could start speaking at user groups or events about FI, I’ve thought about this to bring a FI perspective to engineering conferences or meetups

Just some ideas I’ve had myself that could help! Looking forward to reading more posts!

Adam

December 16, 2019

Ohh nice, some good ideas there. I like the idea of doing something different from coding too. When I was working and coding all day there were times I didn’t want to go home and code. I worry that might feel too similar. Helping other people learn to code might work out though with the right place to volunteer. I’ll check out CodeNinja and see. Thanks for the brainstorm! Lot of good ones for me to think about!

Joe

December 16, 2019

Really great post (as usual).

As for me its been an adjustment (even at 2yrs out). At first I couldn’t shake the feeling that the ’employment police’ were going to haul me away for grocery shopping during working hours. Then I spent time rehashing my prior jobs (of course no one dwells on the positive). Then my mom injured herself and it seemed like a good time to consolidate households and help her out.

I did spend some time leaning to cook. On the menu: Breads, Pad See Ew, Broccoli Beef, Chow Mein (NY style) Pototo Panckaes, Potatoes with Cumin, Roasts, Breaded Chicken Cutlets, Breaded Tilapia, Tilapia Ceveche, Chocolate Moose, Chocolate Chip Cookies, etc.

As far as investing I’ve been trying (for some time) to convince myself that Passive ETFs are the way to go. Outside of large cap, passive ETF performance is downright mediocre/poor in nearly every other capitalization when compared to actively managed funds. I still believe it the law of large numbers (financial), ie its much more difficult to grow effectively when you are large (Apple has been proving wrong in this regard). Also, if you depend on broad market ETFs (like VTI) to diversify, then your exposure to Small/Mid sectors is fairly low.

Outside of investments, I’ve been thinking about legacy. As the saying goes you cant take it with you (unfortunately). My personal preference is I have to give away free-money then I prefer to invest it in ways that move society/technology forward. Sort of like venture philanthropy. Not sure the notion exist currently other than in the arts?

Adam

December 17, 2019

Two years out already? Time flies!

It’s funny how true that is for me too. ?I still get together and hang out with some old coworkers and I’m constantly curious about how good/bad things are since I left. There’s a missing “office gossip” part that is still slowly fading away (I’m sure it doesn’t help that I still have $100k in company stock).

Those sound tasty for sure! It kind of makes me want to take a cooking class to get more exposure to dishes I might not otherwise choose to make but I’d no doubt love.

One thing that I’ve noticed is that in any given year there are always a few actively managed funds that beat the index (ex. S&P 500). Even looking over 3 or 5 years some are stronger. But over 10 years+ the ones that tend to outperform seem to be sectors that have done especially well during that period like Health Care. Actively managed, broad-market funds underperform on the long term. Are there specific funds you’re thinking of that have outperformed index funds?

It’s almost funny how little VTI/VTSAX is driven by small/mid cap companies. Just look at VTSAX vs S&P 500 over the last 10 years and their returns are basically identical.

That’s a tough one since pretty much any technology company is run for-profit rather than as a non-profit. I like the idea of giving money to research that betters the human race long-term, but not sure on how that’s possible either.

Some of the best ways today seem to be a long-term, less direct approach. Lifting people around the world out of poverty and sickness so there are more minds working on those long-term issues. Spreading education worldwide so more people can be tackling problems facing the world from different and unique backgrounds.

Joe

December 17, 2019

I miss the gossip also but I suppose it’s not too healthy to dwell on this kind of stuff.

As far as investing, here are some active small/mid funds that easily beat the S&P over a 10yr period. KAUFX-Federated Investors, OTCFX-T Rowe Price, JAVTX-Janus Funds, WSMNX-William Blair Funds, PRDSX-T Rowe Price, BUFTX-Buffalo Funds.

I think your point about the 10yr performance of VTI vs S&P being similar is interesting. I would have used VXF 6/53/41 Large/Mid/Small for the comparison since VTI is roughly 80/15/5. While the point still holds, over longer periods VXF outperforms more convincingly.So I carry a larger weighting in small/mid funds than market cap weighting would suggest.

I suppose if one averages the performance of all active managed funds, then the result is likely unimpressive and likely to under perform a similar low-cost passive index fund. However, (I hope) folks dont choose investment funds this way and select a fund/fund company with a decent long-term track record or use sector based criteria. A Morningstar subscription is useful in this regard.

I do hold health care positions PRHSX, VGHCX which have performed well. I’m building a position in ARKK-ARK Investments. They invest in speculative tech, but their research seem pretty good. I’ve learned new stuff just reading their research notes.

As far as education for the masses, I’m a bit dubious. Since everything conveyed is likely homogenized/standardized/purified western content, then the effect is to destroy local culture/traditions. Who is to decide what is taught? Is this really a good thing?

Jenika

December 16, 2019

I love reading these updates! I see other people have suggested places to volunteer, and the exact thing you like will depend on the organization, the people you volunteer with, and the actual tasks you perform. Sometimes there’s a disconnect between a mission you value and the actual things you like to do, but when you can find a good balance between those things it becomes very addicting. There’s nothing wrong with doing a few one-off events and “shopping around” for the right place!

Once you find a thing you enjoy, I’ve found the best thing to do is start with a small, regularly-scheduled commitment. I’ve been volunteering a LOT the past few years (250 hours in 2017, 308 in 2018, and ~240 for 2019), but I started out with a 3 hour commitment once a month. Having that one time slot where someone was depending on me was a good incentive without overwhelming my schedule, and soon enough I had a full year with an organization I cared about (with only 36 hours of actual time spent!). I do think it’s easy to overextend yourself, but since you’re keeping an eye on that with your everyday hobbies, it should be less of a worry.

Adam

December 17, 2019

Thanks, Jenika!

That sounds like exactly the trouble I’ve faced. I’ve volunteered places I’ve loved the mission, but haven’t enjoyed the actual help there – which made it rough.

Whew, I knew you volunteered a lot, but how you can do that with work and school is beyond me! Starting small sounds like a good way to start. I think I’d approach it the same way – having someone depend on me for something basically means it will get done whether I like it or not. A 3-hour commitment once a month doesn’t sound like much, but it’s still better than I’m currently doing. I think that’ll be a goal of mine for 2020 – even if that’s just 1 day a month it’ll be a good start.

Crispy Doc

December 17, 2019

Sounds like quite a year. Had a thought about the volunteering facet for you. Our kids are finally old enough to volunteer as a family, and we go monthly to serve a meal at a homeless shelter.

To separate the ability to serve from the profession you are known for, to be just another volunteer, brings an added dimension of humility to the equation. It’s actually one of the places I find flow from time to time. Something to consider incorporating once you find the right fit.

Thanks for making yourself vulnerable,

CD

Christine

December 19, 2019

Great update. Trying to tamp down the jealousy. 🙂

As for volunteering, the first year my friend and I started volunteering seriously (we made a vow to change our monthly eating out together into monthly volunteering together to both save money and feel like we were actually doing something productive with our time, lol), we tried a different volunteer organization/activity every month.

At the end of that year, we chatted about which ones we liked best (philosophies that matched our interest, activities that we could see ourselves doing monthly, best organized <–this is a big one! not all non-profits have their $hit together) and focused on those. It was a nice way to dip our toes into it. We also had some things we did annually (local telethon, nonprofit fundraiser, festival volunteer, etc).

That was six or seven years ago, and we recently had another chat about things that we aren’t enjoying anymore, that we didn’t have time for because the asks had changed, that we thought we should step aside to give other folks an opportunity, etc. So once you get into the groove of something, maybe give yourself permission to step away/step back/swap out occasionally…

Good luck!

Diego Rodriguez

December 20, 2019

I loved this update and what you’re doing.

It has been very helpful (and inspiring) to see your progress.

Adam

December 23, 2019

Thanks Diego!

ark

December 22, 2019

You don’t mention health insurance costs. Those are a big chunk of my monthly costs and I expect them to go up once COBRA ends. I guess you’re still getting insurance through Mrs. Minafi’s employment?

Adam

December 23, 2019

Yep! That’s been helpful for this year for sure. We’ve priced out how much it would be for insurance when she leaves and it’s looking like around $1,000/month for the two of us – or about $500/month if we can get our income under $64,000 a year. A $6,000 savings is no joke for simply having a lower income during a given year.

I’m not sure yet on how much COBRA will cost in that situation though. If it’s comparable with ACA coverage we’d prefer to stick with COBRA too.

How have your COBRA premiums been?

ark

December 23, 2019

We’re paying $1500/month on COBRA for a family of 3. I expect ACA (by covered CA) will cost upto $2500 for not quite as good coverage. I’m actually considering going back to work just long enough to qualify for COBRA again and then quitting to get another 18 months 🙂

Adam

December 23, 2019

Ohh that’s interesting! We should be finding out how much our COBRA coverage is in a few weeks. I’m crossing my fingers it’s less than $500/person.

Fireside chat

December 23, 2019

Another fire post building a brand off what ? Teach me options trading or how to beat the casino …… I love all these fire side chats. How much for your Bootcamp ?

Adam

December 23, 2019

I debated removing this post as spam. Instead here are some real answers! Feel free to reply with any follow-ups.

Everyone has their own story. This blog is just part of mine – including a few years of my journey to FIRE followed by a change this past year to what my first year of FIRE has been.

In terms of my “brand”, it’s always been a combination of minimalism, mindfulness and financial independence. There’s nothing unique to the world about those concepts, but I like to think that by combining them I occasionally shed a light on some new ideas. 🙂

I also love interactive content like the Interactive Guide to FIRE, an interactive guide to diversification, an analysis of the gender pay gap through data or the Periodic Table of FIRE. I really want to do more of those!

Whew, yeah that’s not going to happen. My minimal approach to investing is all about diversified, low-fee, index fund investing using a buy and hold strategy. Nothing you can’t learn by reading Bogleheads. My hope is to be one more voice of “good” info out there on the internet.

The first course is free, the remaining 9 courses are going to start at $129 now while I’m building them, then most likely $229 after that. It’s also 100% free for teachers, students and anyone who has served in the military.

My hope is to subsidize it for the greatest amount of people by having some people actually pay for it. After spending the last 8 years working at places where I made online courses, it’s been a lot of fun to create one on my own!

There’s a sense of stigma in the finance community about selling things. It seems to come down to two complaints:

Making money from selling the promise of “early retirement” like the author, when it’s not likely repeatable.

You’re only able to retire early because of #1.

For #1, if you check out the boot camp, you’ll see it’s very much an “investment basics” boot camp. It’s trying to bring together the knowledge you’d learn in your first few years investing in index funds and putting that all in one ordered curriculum. Also, Minafi loses money every month, so it’s currently an expensive hobby.

For #2, it’s less clear long-term. I share all my numbers if you dig deeper into this blog. You’ll see that we currently have about 25x our expenses saved up in low-fee index funds. Increasing that up to 33x would be really nice. Lucky for me there’s no retirement police that are going to arrest me for making money on my work. ?

Every Extra Dollar

April 27, 2020

A hearty congratulations to you!

It’s not everyday you walk into people or young guys who have gotten their finances properly figured out and actually retire early.

It’s totally worthy of emulation, although, it’s much easier to be envious right now.

I love your blog! I love the way you write! I love the way you take pictures! I mean, I don’t know your blog before now, but I’m definitely sticking.

It’s been a long while I’ve read a personal finance blog with a touch of personal “what have you”

Great job Adam!

Chelsea Wilde

June 25, 2024

Hire a Licensed Hacker- Bliss Paradox Recovery to get a stolen bitcoin back. Inasmuch as there are so many recovery experts out here, I would like to recommend one of the best and reputable hacker who saved me from losing $432k worth of bitcoin that was frozen in Proton 5 wallet. Came across a review about how they helped so many victims of crypto scam. I got so lucky to be among their testifiers. You can reach out to them through email Blissparadoxrecovery @ aol. com if you need help. Other contact details: Telegram- Blissparadoxrecovery WhatsApp +1 3 8 0 2 0 6 9 7 1 2 Signal No. (862) 282-3879 Web- https://dev-blissparadoxrecovery.pantheonsite.io This article is to whom it may concern, ignore if you are not a victim of crypto scam. Regards!

andrew peace

February 12, 2026

If your crypto investment account is locked, compromised, or hacked, I recommend contacting WIZARD HILTON CYBER TECH recovery firm. Last month, I sought their assistance after falling victim to a crypto scam that left me feeling hopeless and helpless. However, they proved me wrong by helping me retrieve the funds that were stuck on the fraudulent website. Losing money to the website was an extremely devastating experience, and I deeply regretted my initial decision to invest. Despite my wife’s initial opposition, I proceeded with the investment in hopes of securing long-term financial support for my family. Unfortunately, I lost a total of £119,000, which came from our family savings. To prevent my wife from discovering the loss, considering she had warned me about potential risks, I reached out to WIZARD HILTON CYBER TECH via email at “ wizardhiltoncybertech ( @ ) gmail (. ) com” This turned out to be the best decision I made, as they swiftly recovered my funds within a couple of days. I am grateful for their assistance. You can also reach them through their WhatsApp Number +18737715701 or the provided email address.

andrew peace

February 12, 2026

If your crypto investment account is locked, compromised, or hacked, I recommend contacting WIZARD HILTON CYBER TECH recovery firm. Last month, I sought their assistance after falling victim to a crypto scam that left me feeling hopeless and helpless. However, they proved me wrong by helping me retrieve the funds that were stuck on the fraudulent website. Losing money to the website was an extremely devastating experience, and I deeply regretted my initial decision to invest. Despite my wife’s initial opposition, I proceeded with the investment in hopes of securing long-term financial support for my family. Unfortunately, I lost a total of £119,000, which came from our family savings. To prevent my wife from discovering the loss, considering she had warned me about potential risks, I reached out to WIZARD HILTON CYBER TECH via email at “ wizardhiltoncybertech ( @ ) gmail (. ) com” This turned out to be the best decision I made, as they swiftly recovered my funds within a couple of days. I am grateful for their assistance. You can also reach them through their WhatsApp Number +18737715701 or the provided email address.

andrew peace

February 12, 2026

If your crypto investment account is locked, compromised, or hacked, I recommend contacting WIZARD HILTON CYBER TECH recovery firm. Last month, I sought their assistance after falling victim to a crypto scam that left me feeling hopeless and helpless. However, they proved me wrong by helping me retrieve the funds that were stuck on the fraudulent website. Losing money to the website was an extremely devastating experience, and I deeply regretted my initial decision to invest. Despite my wife’s initial opposition, I proceeded with the investment in hopes of securing long-term financial support for my family. Unfortunately, I lost a total of £119,000, which came from our family savings. To prevent my wife from discovering the loss, considering she had warned me about potential risks, I reached out to WIZARD HILTON CYBER TECH via email at “ wizardhiltoncybertech ( @ ) gmail (. ) com” This turned out to be the best decision I made, as they swiftly recovered my funds within a couple of days. I am grateful for their assistance. You can also reach them through their WhatsApp Number +18737715701 or the provided email address.