Minafi's Take on FNILX vs FZROX

These two Fidelity funds are part of their new lineup of zero-index funds. They both charge a 0% expense ratio – the lowest in the industry.

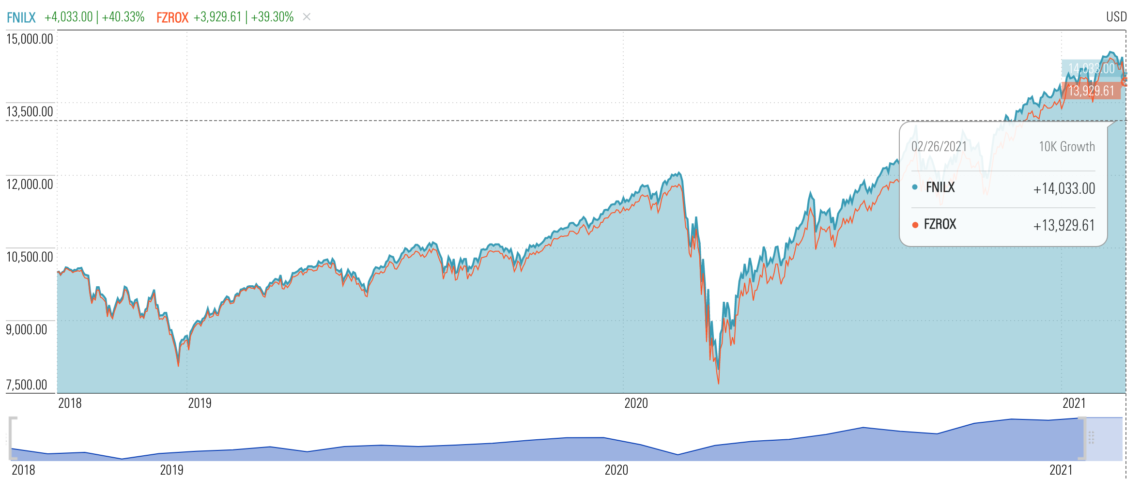

These two funds are extremely similar. They both mostly in large companies in the US, which means their performances will be similar. We can look at their performance over the last 3 years and confirm this.

The performance difference between these two funds since their inception is about 0.4% – less than 0.1% difference per year! These funds are still new. Three years isn’t much time to compare. More time will be needed to see how they track long-term.

What Are They?

$FZROX is a US Total Market Index Fund – like $VTSAX or $FSKAX. It invests in 2,442 US companies [as of March 1, 2021] – with 22% of its holding in the largest 10 companies. Like most total market funds, it’s large-cap weighted. That means that about 80% of its holdings are in the largest 500 companies in the US, while about 20% of its holdings are in the other ~2,000 mid and small-cap companies.

$FNILX is a US Large Cap Index Fund. It invests in 516 companies – effectively making it an S&P 500 index fund. 26.5% of its holdings are in its largest 10 companies. Since it’s not officially an S&P 500 index fund, it will invest in companies that are large before they are added to the S&P 500. This was useful in 2020 when this fund invested in Tesla before it was officially added. This makes it slightly more adaptable, and will more closely match the performance of $FZROX compared to an S&P 500 Index fund.

These are two of the four zero-fee index funds that Fidelity offers:

- $FNILX – Fidelity ZERO Large Cap Index Fund [US Large Cap]

- $FZROX – Fidelity ZERO Total Market Index Fund [US Total Market]

- $FZIPX – Fidelity ZERO Extended Market Index Fund [US Medium Cap]

- $FZILX – Fidelity ZERO International Index Fund [International Total Market]

Since these are Fidelity mutual funds (as opposed to ETFs), the best place to invest in them will be at Fidelity. If you invest somewhere else, you may end up paying transaction fees to purchase these funds – which wouldn’t be worth it.

Which Should You Invest In?

Both of these funds are in the top tier of awesome funds – as reflected in their Minafi FI Scores. Since they track about ~80% of the same companies, there’s not going to be a large difference between these.

If you have an S&P 500 index fund in your portfolio already, I’d consider choosing $FZROX – since that would further diversify your portfolio.

If you’re choosing your first fund to invest in, maybe in your 401(k) or an investment account, I’d also choose $FZROX. Historically small and medium cap companies have outperformed the S&P 500 in terms of growth. If that trend continues then that added diversification would tip the growth towards $FZROX in the long term.

Ultimately you’re choosing between two great funds with identical fees and similar holdings. The best one for you is the one that’ll further diversify your portfolio the most.

What’s the Downside?

Since these are both zero fee funds, you might be thinking – what’s the downside? They’re both relatively new, with a small (but growing) amount of assets under management.

Something to keep in mind: Fidelity is out to make money off you. That’s their entire point of existing. While these funds are free, there are other Fidelity funds that charge higher than average fees.

There’s a name for this: a loss leader. Fidelity’s Zero-Index funds are exactly that. They’re offered to entice people to sign up with Fidelity so get them in the door so they can make money off you selecting some other higher fee funds. Keep that in mind when planning out your portfolio!